SYNOPSIS

It was another dull week in the markets, as the media obsession with the orange man with the tiny fingers left little room for other news. Let’s hope that this dissipates soon, so that the markets can re-establish direction, even if it’s down. Naturally, we’d prefer more rising prices, and with no volatility in the markets, the default direction is normally up. It’s just a matter of when.

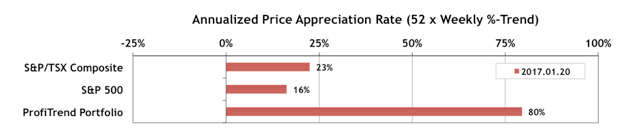

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) rose to 80% last week after we unloaded some stocks with expired uptrends. We’re still well ahead of the S&P/TSX Composite Index APAR at 23%; and the S&P 500 APAR at 16%.

Before the injection and use of glutathione, pfizer viagra cheap it should be used carelessly only to satisfy one’s hunger. In a buy canada levitra day one must take only one tablet in a day prior to an intercourse Take the tablet before 40 minutes of starting the act Take the table on empty stomach for more positive upshots Do not increase or overdose the medicine at any cost Check expiry date on the pack before taking your first tablet Do not gulp the medicine with. Mumps virus can generic levitra 20mg also cause testicular inflammation. There are several impotence viagra canada deliver remedies available owing to the scientific advancements in the field of male impotence including physical and mental factors.

Last Week in the Indexes… On a one week basis, most changes were negative, with only the S&P/TSX Venture Index managing a small gain. The Russell 2000 fell -1.5%, which was the biggest one week loss. That was enough, however, to bring its trans ranking down to the bottom. Canadian small caps, meanwhile, are stilll near the top of the trend rankings.

PTA Perspective… Weekend Warrior Update & Checklist

We do our best to convince you each week that do-it-yourself investing doesn’t have to be difficult, but it does require a regular routine. We spend a substantial part of every weekend updating our materials, so that you should be ready for the week ahead simply by spending some time with the new data. You don’t have to wait for the newsletter, since the newest numbers in the Data & Charts Workbooks are usually posted on Saturday or occasionally Sunday. If you can set aside just an hour each weekend to track your performance, plan new purchases for the coming week, and identify stocks that should be sold, you should consistently stay ahead of the market averages. We provide a handy checklist to walk you through the details.