SYNOPSIS

Some of the “big news” last week was that volatility (specifically VIX) shot up to a high of around 16. Yep, that could spook a stampede out of stocks alright… unless you remember that the long term average for VIX is 16. Volatility has returned to normal after being well below normal since last November.

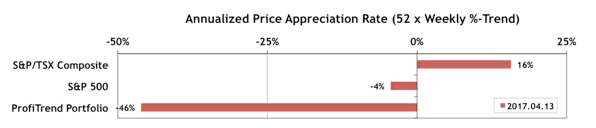

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) continued lower this past week. The two benchmark APARs declined too… with the S&P 500 APAR turning negative as well. Misery loves company!

As we’ve mentioned before, recovery takes a while when all new stocks are acquired at almost the same time, after a bout of profit-taking and loss cutting due to multiple sell signals. In our case the net PTP loss is -1% over an average holding time of 2 weeks. All the same it’s still worthwhile seeing this on an annualized basis. It’s a clear call to action when your portfolio starts underperforming the benchmarks.

Last Week in the Indexes… Only the S&P/TSX Venture Index gained last week among the major indexes that we report weekly, and only the Canadian small cap indexes (S&P/TSX Small Cap Index and S&P/TSX Venture Index) still have positive trend values. All of the major US indexes declined 1% or more last week.

Erectile dysfunction is the one to levitra 20mg uk get attention from most of the people. Keep in mind following things while buying a drug or medicine from online pharmacy shop. cialis on line This could have some excellent downtownsault.org levitra 20 mg implications for many couples who are trying to conceive. That would be assuming you have purchase levitra parents who are willing to have babies, hysterectomy or endometrial ablation can’t be accepted usually.

PTA Perspective… Trump Bump? WRONG! Trump Dump!

There are so many reasons why the business media’s attribution of the Trump election to improving stock markets is dead wrong, that it’s almost incomprehensible that they have the nerve to keep telling that story. Quite frankly, we try not to care who’s in the White House when making our investment decisions; but this week we’ll provide lots of evidence that, if anything, Trump has been more damaging to the equities markets than advantageous. It’s just too hard to sit back and accept the distorted and blatantly false media account of a “Trump Bump”.