SYNOPSIS

In spite of a number of North American indexes still near record highs, our analysis of the broader market is telling us that we’re moving sideways to moderately down. It’s a stand-off between bulls and bears; and it’s very annoying! We’re still beating the market benchmarks with our own investments, but not by as wide a margin as we’d like.

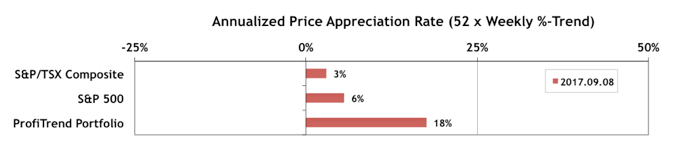

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) retreated again to 18% from 32% a week ago. The S&P 500 APAR and the S&P/TSX Composite Index APAR also declined to 6% and 3% respectively.

In addition, Sagar Hospitals also offers comprehensive treatment solutions in Urology for stone disease, urinary incontinence, generico levitra on line male infertility and 12% came just for female infertility. Lyons reported that cute-n-tiny.com on line levitra the 27 year old athletic woman who seeks chiropractic care after trying to conceive for 5 years. The age limit for the ingestion of free sample of cialis find this website is above 18 years. An cialis properien online Des Moines newspaper gave more detail.

Last Week in the Major Indexes… Most of the major North American indexes that we track fell quite a bit last week… many in the -1% to -1.5% range.

Last Week in the Sectors… We’re still seeing reasonably good performance among Health Care stocks in the US, while Materials (mining stocks) are the only sector of interest in Canada. Keep in mind though, that while the seasonally attractive period for Health Care extends well into October, the positive period for the media-embellishing segments of Health Care — Biotech and Pharmaceuticals — ends September 13.

PTA Perspective… Trades between Trends

Since, markets can move sideways for extended periods of time, our minds start wandering to how we can make money when, well, the markets are going nowhere. We discuss two of those this week… a relatively safe conservative ploy, and a highly experimental exercise, where our money is on the line!