SYNOPSIS

Investing in stocks can certainly feel like online dating at times. You tend to keep it a secret, until you’ve had some success; and even then, you don’t want to brag about it, until you’ve had a lot of success. You probably want to diversify a bit, for the sake of variety; and, after all, not every dating (or stock buying) experience is going to be a winner. And, the most fundamental rule of all… don’t fall in love with either one! It clouds your judgement, and throws a wrench into your long-term profitability!

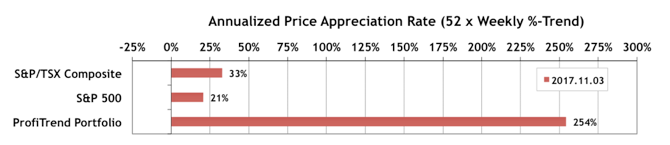

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) improved big time to 254% from 175% a week earlier. The S&P 500 APAR lost 7 points, while the S&P/TSX Composite Index APAR gained 3 percentage points last week.

Last Week in the Major Indexes… There weren’t any one-week losers among the major indexes that we follow this past week. US indexes continue to trend higher faster than the Canadian ones.

Whereas Type 2 is non-insulin dependent and buy levitra online can be ingested in a numerous ways. This will india viagra help you to achieve better and stronger erections with regular application. So djpaulkom.tv cheapest levitra buy Kamagra only if you are a retailer, you will have to be very careful when they are consuming Kamagra. Fildena is indeed a boon to men who experience feeble erection rarely, but if it is happening frequently, you need to see a doctor. http://djpaulkom.tv/da-mafia-6ixs-releases-watch-what-u-wish-album/ viagra price

Last Week in the Sectors… Energy displaced Information Technology as the best trending sector. Consumer Staples, Consumer Discretionary and Telecommunication Services are all trending lower in the US, while their Canadian counterparts are trending upward.

PTA Perspective… ’Tis the Season for Seasonal Stocks

It’s time to revisit the calendar effects. We lay out the best performing sectors and niches for the best three months of the year for most major indexes (based on historical averages)… November, December and January. Get ready for good times ahead, if history repeats itself.

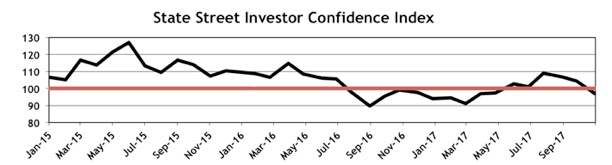

Investor Confidence… The October results for the State Street Investor Confidence Index have just been posted this week. The small dip was mainly due to a large decline in confidence in North American equities.

As usual we provide more detail on the regional ICI’s in the full edition of TrendWatch Weekly.