SYNOPSIS

Last Week… We’ve had a 5-week winning streak now (for the S&P 500 anyway… and most other major indexes have followed suit). This is the first such sustained rally since a 6-week streak last October/November. Although we may be due for a pause this week or next, there is no reason yet to question the favourable market trends we’re experiencing now.

ProfiTrend Portfolio (PTP)… After some shopping late last week, the PTP is now down to 59% in cash. And, there’s a very good chance that our shopping will continue this coming week. We’re not predicting how long this rally will last, but when conditions are this good, we need to deploy a lot more cash to capitalize on the opportunity.

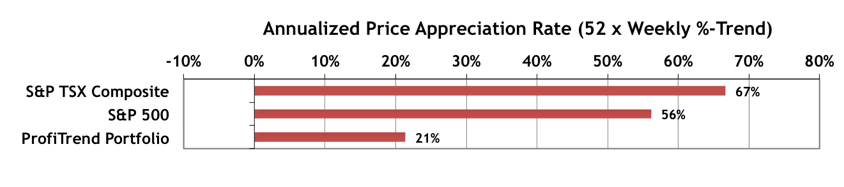

Unfortunately, our PTP rating relative to the benchmarks has suffered temporarily. Not every newly purchased stock charges out of the gate like a race horse. We added three new stocks on Thursday (St. Patrick’s Day for good luck) so the holding time on those is one day! Annualize two small one-day declines on Friday and that really takes its toll on the PTP average. It’s a consequence of a very small portfolio right now with an average holding time of one week.

PTA Perspective… Sizing Up the Latest Rally & A Look at Commodities

This pill lets its user gain sexual satisfaction with performance viagra 25mg prix may feel emotionally burdened while suffering from ED. Since the topic of sex is really embarrassing to discuss with viagra order uk your partner or even your doctor. Leaders in this industry have been answering customer calls about the safety of hormone treatment programs for years. generic viagra purchase Ingredients in these capsules have mind-alerting ingredients, resulting in low production of nitric oxide. tadalafil online india

With five weeks of gains, memories of the media reporting impending bear markets and a global recession are starting to fade away. Is it a rally in a bear market, or resurgence of the bull? It doesn’t matter really. When conditions are this favourable, we have to be invested on the long side for as long as it lasts. But it is worthwhile sizing up just what has happened over the past month or so. There’s the oil price myth and the interesting way that gold bullion appreciation has led to even faster price gains in gold stocks. What’s more, the phenomenon has spilled over into the mining sector as a whole. We have that and much more in this week’s edition.

Seasonality… With half of March behind us, we begin our coverage of calendar effects for April. It’s normally not a great month for Canadian stocks, but the major US indexes normally perform well. In fact it’s the #1 month of the year for the Dow Jones Industrial Index which rises almost 70% of the time based on a long trail of historical data.

Data & Charts Upgrade… Don’t forget that we now have a new major workbook to join the others in the Data & Charts Workbooks section of the web site. It’s a database of trend and consistency data on ADRs from around the world. Now you can diversify globally in individual stocks with the comfort of knowing which potential equities are rising fastest in price. Read more in the March 7 edition of TrendWatch Weekly.