SYNOPSIS

Yes, it’s terrifying being chained to a bicycle careening down a mountain with no brakes! Especially when the TV news media’s main mission these days is to generate fear to the point of hysteria. That keeps the eyeballs coming back and media ad revenue going through the roof… all at the viewers’ expense. But you’re not really chained on. You can make it stop by turning it off. Get just the information you need in a controlled fashion from reliable print sources (onscreen or old-fashion newspapers). Or, better yet, just access the emotionless raw data and calculate your own conclusions.

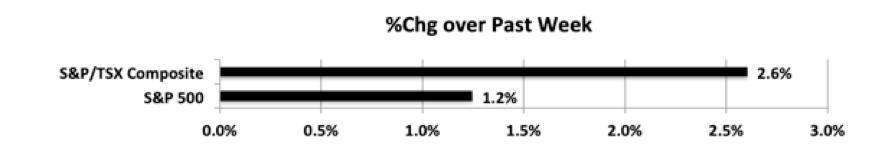

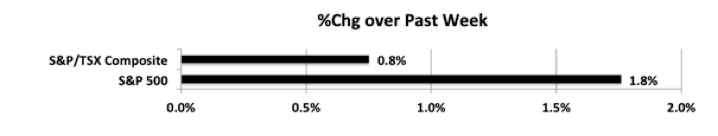

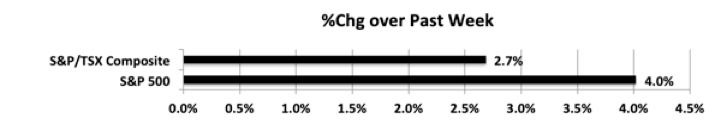

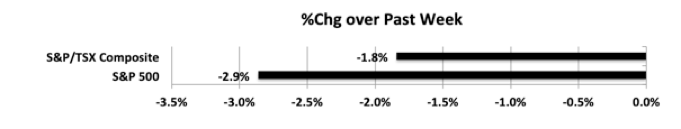

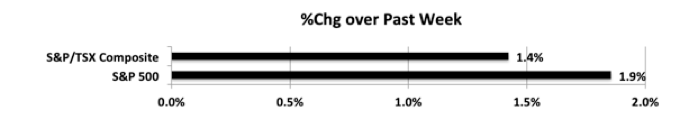

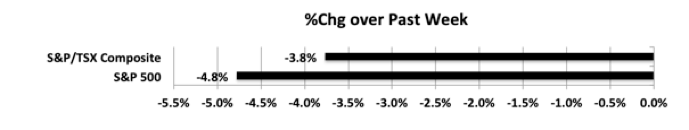

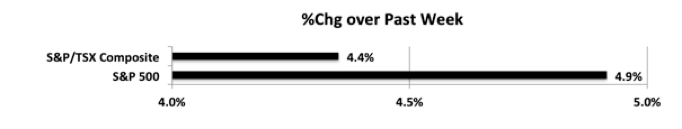

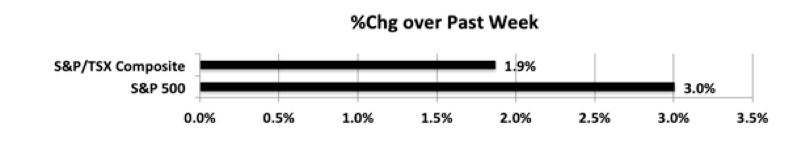

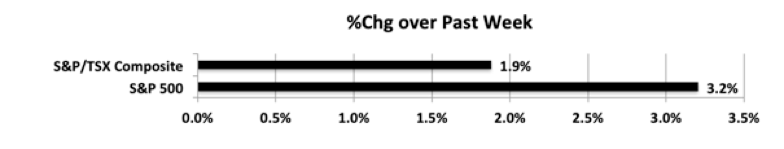

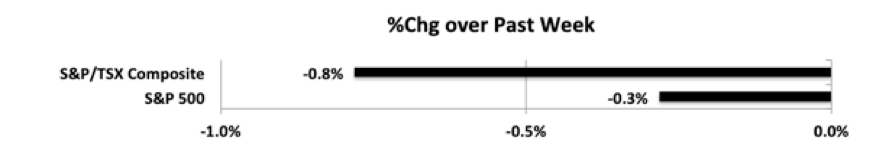

Last week… We experienced a pull-back this past week after three consecutive weeks of advances for our two favourite indexes. Not much to worry about (yet).

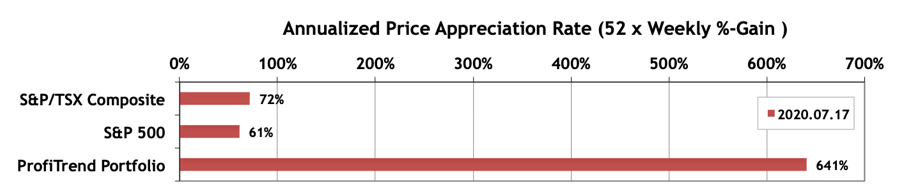

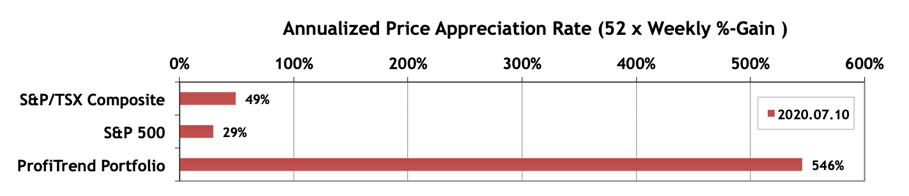

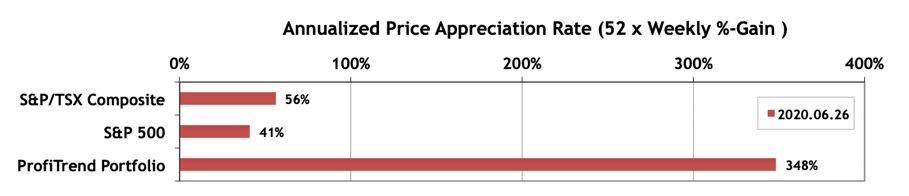

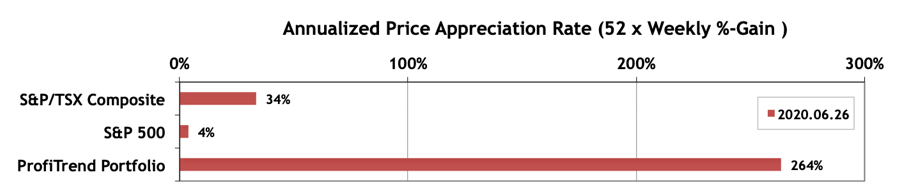

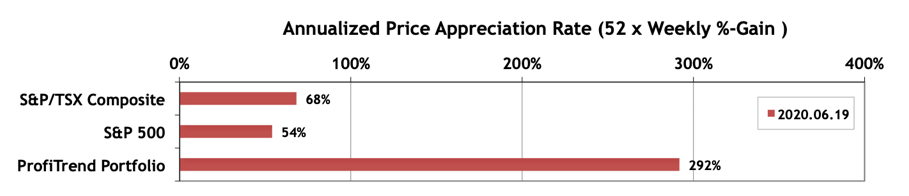

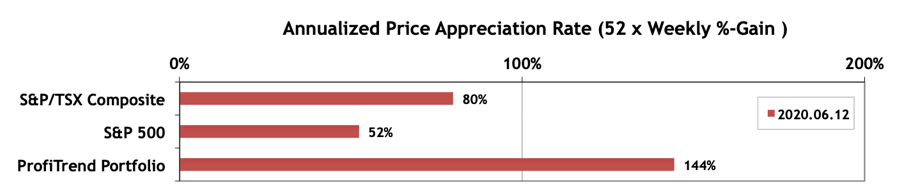

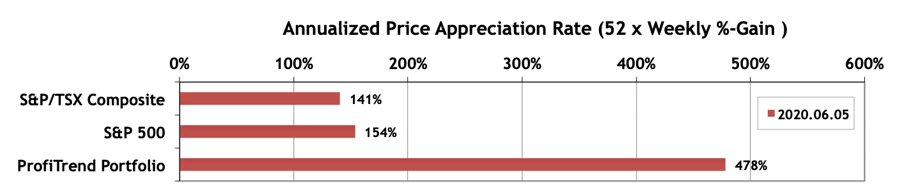

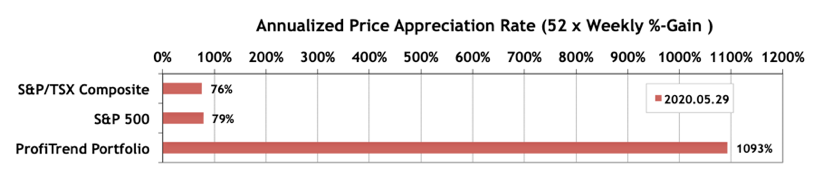

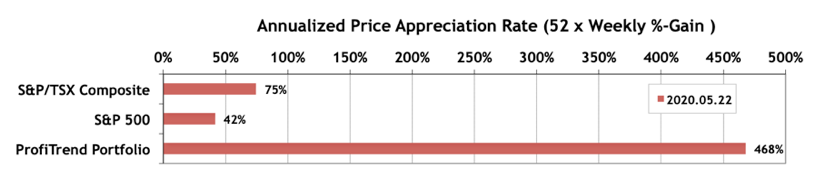

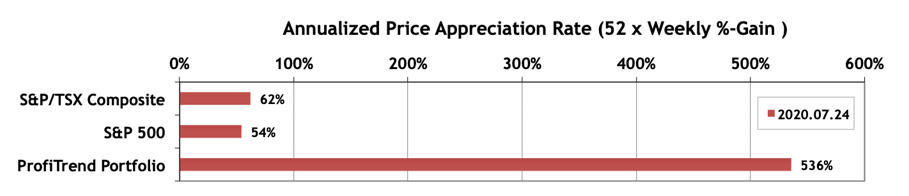

PTP… The S&P 500 and S&P/TSX Composite Index APARs declined 7 and 10 points respectively, and our PTP APAR dropped about 100 points to a still-respectable level above 500%.

PTA Perspective… Transportation as a Service (TaaS): Another Thematic Exploration

This week we begin coverage of a new thematic sector that has some challenges… Transportation as a Service (TaaS). We’re poised not only to shift from gasoline/diesel fuelled vehicles to electric, but also to transition to ride-sharing as an alternative to vehicle ownership. And, that is only the beginning. So, in this week’s Perspective section, we offer the beginnings of a tutorial in how to prepare for investing in what promises to be an exciting growth area involving a number of disruptive technologies.