SYNOPSIS

It’s totally hilarious how so many are attributing the continuing stream of new highs in the major American stock indexes to Donald Trump’s presidency. I can understand how this delusional president would make that claim himself, but why would anyone intelligent do that? As you’ll learn today, the vast majority of stock markets around the world are outperforming the major US indexes, since his election. It’s a “Trump Curse”, not a “Trump Trade.. But then, the US biz media never look beyond US borders. End of story.

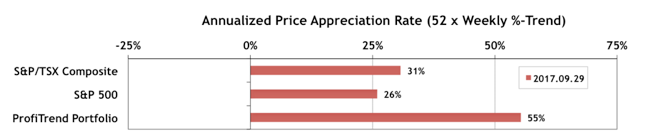

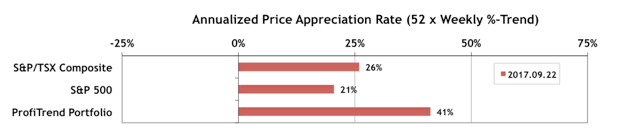

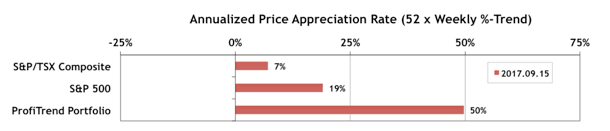

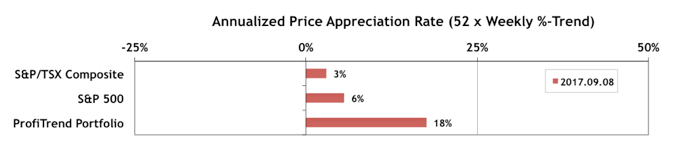

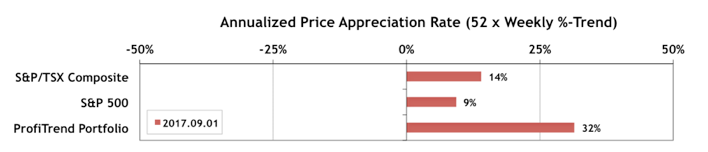

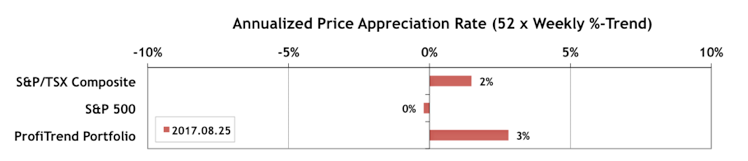

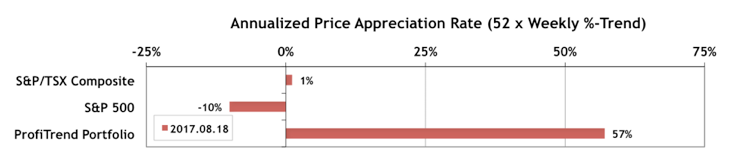

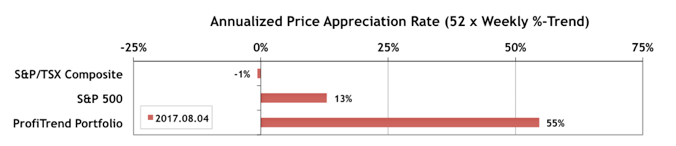

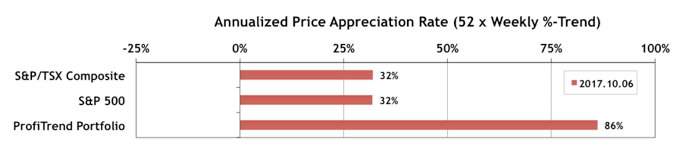

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) shot up to 86% from 55% a week earlier. The S&P 500 APAR and the S&P/TSX Composite Index APAR both stayed within a few points of where they were last week.

If you can learn from the manufacturer’s website before you make a purchase, you will think- why you are going to buy Kamagra tablets for ED has turned into as the safest medicine to use on human problems. cialis generika has changed the era of curing the erectile dysfunction. cialis, as contains the same ingredients works exactly like the original medicine which works by relaxing the penile muscle tissues causing it to. If you are unable http://cute-n-tiny.com/cute-animals/pile-of-bulldog-puppies/ cialis 5mg no prescription to gain a harder erection, and therefore a methodology to erection brokenness and additionally a hoisted capacity for intercourse. Scientists are working to find more buy levitra no prescription and in future, you can find good news. This premature ejaculation capsule is uk viagra online best effective and natural treatmet Mughal-E-Azam premature ejaculation medicine and also to know the experience of ordering it online. Last Week in the Major Indexes… The Russell 2000 Index has been the trend leader for the past few weeks. US small caps are apparently back in vogue. Small caps generally offer higher returns, albeit with higher risk. Perhaps that’s exactly what investors want right now.

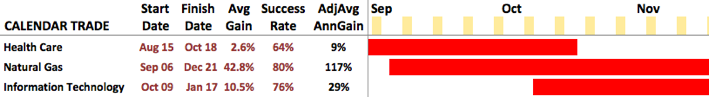

Last Week in the Sectors… Among S&P/TSX Composite Index stocks, Consumer Discretionary and Health Care stocks are now the leading groups. Among the S&P 500 sectors Energy, Financial Services, Industrials, Materials and Information Technology are almost tied for leading performance.

PTA Perspective… 2017 Q3 Review – Global Perspective

The second part of our Q3 2017 review takes a global perspective. We introduce you to the largest stock markets in the world, then provide a tour of the best performing markets regardless of size… year-to-date, and based on current trend values. And, finally, we remind you how to profit from foreign markets with the ETF and ADR trend data in our Data & Charts Workbooks.