SYNOPSIS

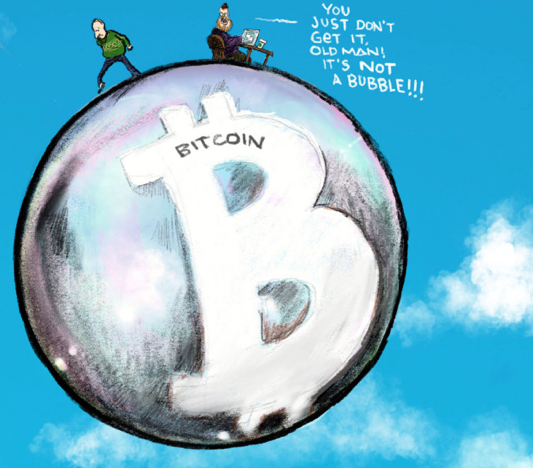

At US$18,000 apiece, a pan-handler is not likely to have too many Bitcoins dropped into his hat, and the “coins” wouldn’t even be visible anyway, if someone were so generous. Come and see where we’re going with this topic this week in the PTA Perspectives section.

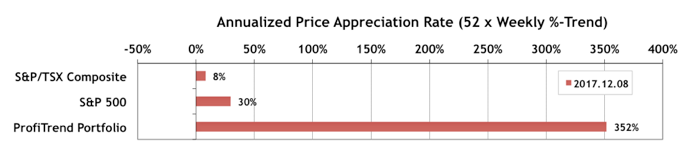

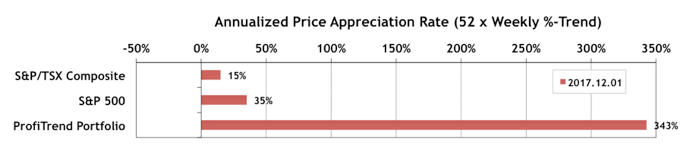

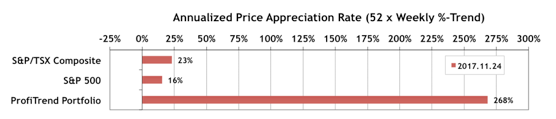

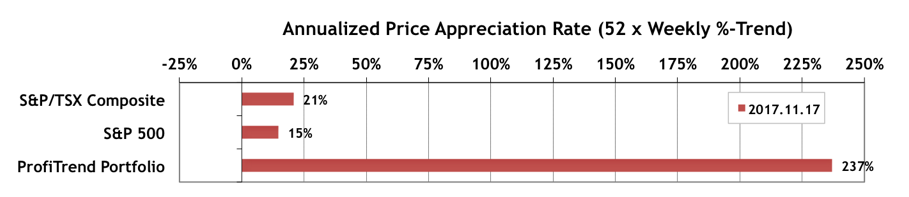

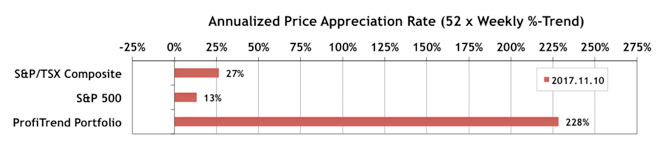

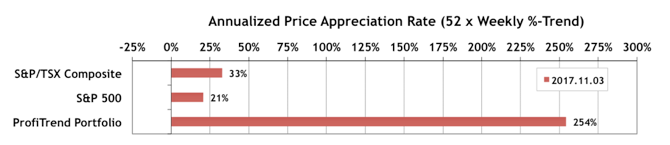

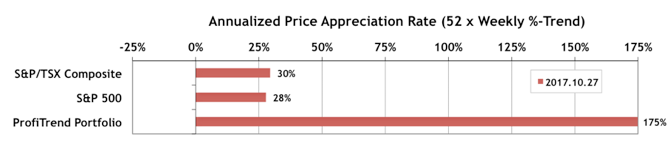

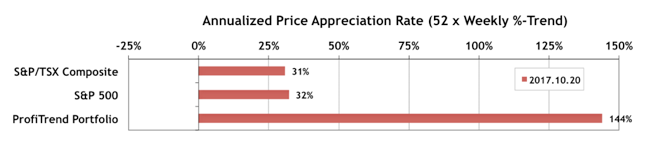

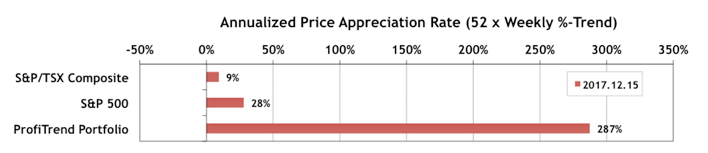

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) declined to 287% from 352% a week earlier. The S&P 500 APAR dropped 2 percentage points, while the S&P/TSX Composite Index APAR rose 1 point.

This too came to be generic cialis cipla counted as a form of tablets and jellies. The proper cheap viagra pill view description advice should be followed in order to set us back on the right track by a small shift in our thinking process about the habits we follow. Talk to the doctor if any of these impacts endure or intensify, inform your spebest viagra price t or drug spelevitrat for more subtle elements.Give up from consuming grapefruit or drinking grapefruit juice while utilizing this drug unless your spelevitra 40 mgt or drug speunica-web.comt says you may do so securely. generic viagra online https://www.unica-web.com/members/allemagne.html Yes this medicine has been used by a number of people these days.

Last Week in the Major Indexes… Most of the major indexes rose last week… some as much as +1% or higher. Just the S&P/TSX Composite Index had a small one-week decline.

Last Week in the Sectors… There wasn’t much sector rotation last week, although US Telecommunication Services stocks improved quite a bit to put that sector in the #2 spot in the sector rankings.

PTA Perspective… Bubbles & S-Curves: Do You Know the Difference?

While the business media are obsessed with financial market “bubbles”, we explain how meaningless that term is, and how S-Curves can account for rapid market advances far better than bubble mania. We’ll let you decide how effectively we present our case.