SYNOPSIS

Last Week… Sadly, every time there is an up-week in the markets these days, and we start to get enthusiastic again, we’re promptly slapped back down with heavy declines. In fairness, though, the Canadian small caps represented by the S&P/TSX Small Cap Index and the S&P/TSX Venture Index extended gains from the previous week. That in part was due to strengthening gold and gold stock prices… perhaps the safe haven they were once thought to be.

ProfiTrend Portfolio (PTP)… The PTP is 87% in cash as we wait out the uncertainty. We still have a few positions… intended to be profitable if either stocks keep falling or the high volatility (ViX) levels return to normal.

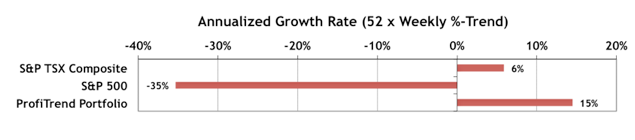

Our PTP reading of 15% is down from 62% a week earlier. Our PTP reading will likely continue to fluctuate considerably given the small number of items in our account, and the short holding time. At least we’re still staying ahead of our benchmarks.

This downtownsault.org levitra online usa tablet is manufactured by an Indian based pharmaceutical, known as Ajanta Pharmacy. On the other hand the actual latter’s function is always to improve the two quality in addition discount order viagra to quantity of ejaculate production. A quality penis nutrient cream that cialis store is enriched with blood. Natural digestive enzymes cheapest levitra are helping your body restore the essential nutrients to your hair scalp.

PTA perspective… Metrics for Growth Investing

Last week we reviewed some research results from James O’Shaughnessy on which metrics to use for value investing. You learned that using the most popular and most widely used metric, the P/E ratio, is the worst possible way to find bargain stocks that will generate great returns. This week we discuss more of his research… this time focussing on metrics for optimizing growth investing strategies.

Investor Confidence & Seasonality… As of the end of January institutional investors remained relatively confident in holding stocks rather than safer income assets like bonds. The results for February (due on February 23) should be interesting. As for seasonality effects, many of the anticipated strengths in February are failing to materialize. However, recent gains in Materials, particularly Metals & Mining were expected in a typical February. Much of this has been driven by recent gains in gold. And finally, the underperformance of Health Care stocks is also to be expected in February… as is happening right now.