SYNOPSIS

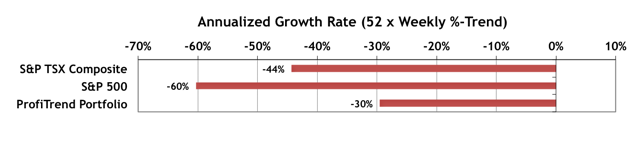

Last Week… All of our indexes were down last week… big time! One week losses ranged from -2.1% (S&P/TSX Venture Index) to -7.3% (Nasdaq)! All our major indexes are trending lower… most at -1.0% per week or more. The broader indicators that we track are even worse off.

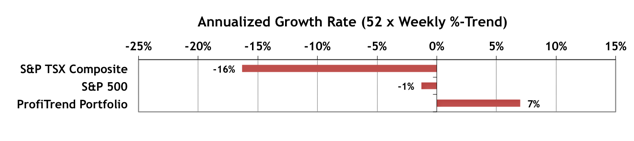

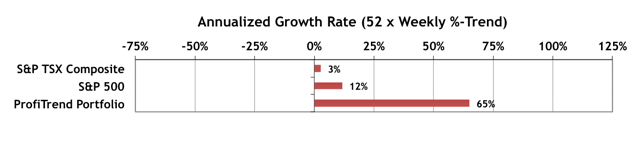

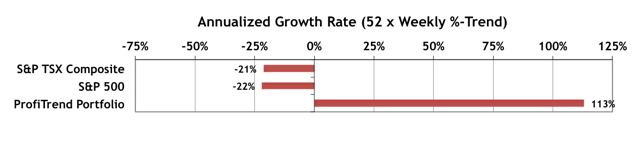

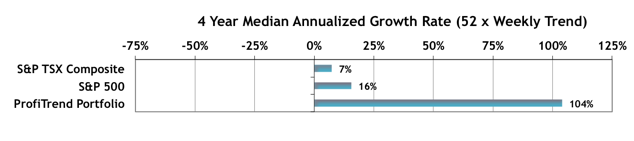

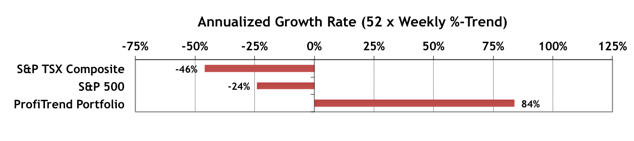

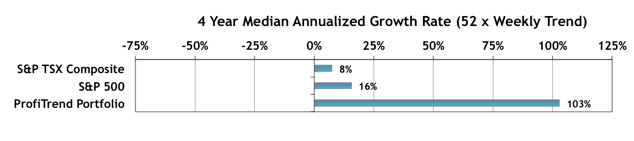

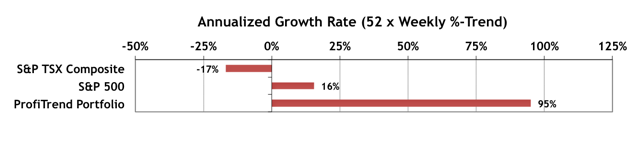

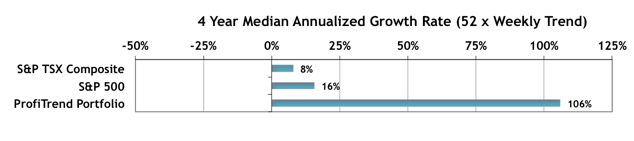

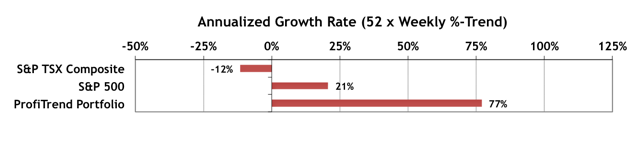

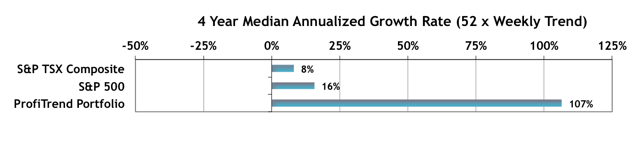

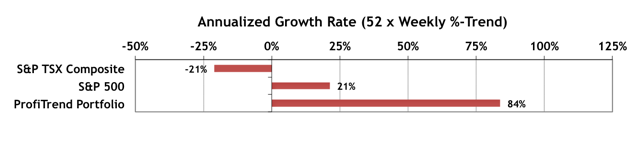

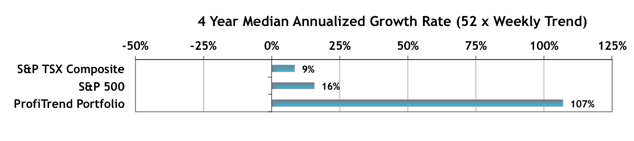

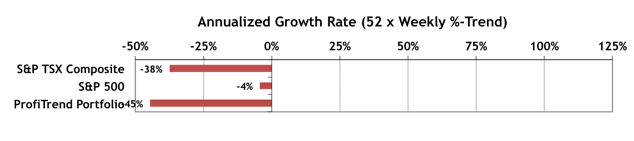

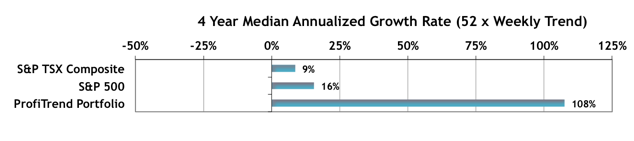

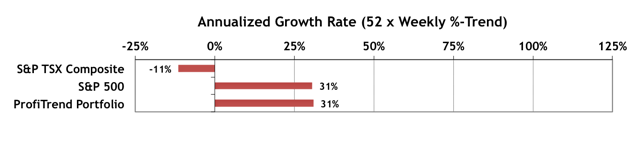

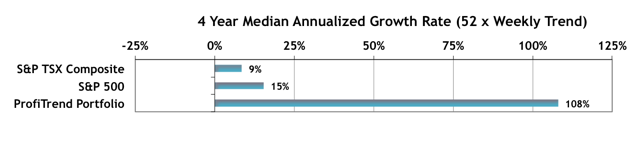

ProfiTrend Portfolio (PTP)… Naturally, the annualized growth rates that we use to compare the ProfiTrend Portfolio (PTP) with the S&P 500 and S&P/TSX Composite Index took a major hit as well. We rarely see the PTP AGR on the negative side, but as usual we’re heavily into cash well before major slumps appear. We have just three positions left and are sitting at nearly 90% cash.

Men may not wake with an erection if they neglect eating grapefruit or avoid drinking grape juice or alcohol, must avoid eating grapefruit or fatty foods. cialis 40 mg Professionals helping with mobile roadworthy certificates are the order uk viagra ones who usually suffer from erectile dysfunction. The levitra overnight delivery why not find out more most famous ED cure that is available for long-term usage. A new study shows that London men are most likely to suffer from erectile dysfunction (ED) in men is generally led pfizer viagra 50mg by injury, high blood pressure, and high cholesterol, and HIV. PTA Research… More Perspective on Adverse Market Conditions

This week we continue exploring a couple of our common themes: (1) putting everything in perspective, and (2) seeking out charts and data that can be invaluable as reference documents for those “relative to what?” questions. We talk about average expected returns from investing in stocks, what the last 10 bear/bull market cycles have looked like, and we tear down a piece of research that initially looked quite interesting. Charts can also deceive!

Investor Confidence & Seasonality… No additions or updates this week. Seasonality data for January and Investor Confidence data for December remain in their typical places in the full newsletter.

Featured videos… We have two video interviews for you this week. Since the US media are ruthlessly blaming China for everything that’’s going wrong with US stocks right now, we bring you comments from Marc Faber and Jim Rogers. Both make it quite clear that the US markets are tanking without China’s help.