SYNOPSIS

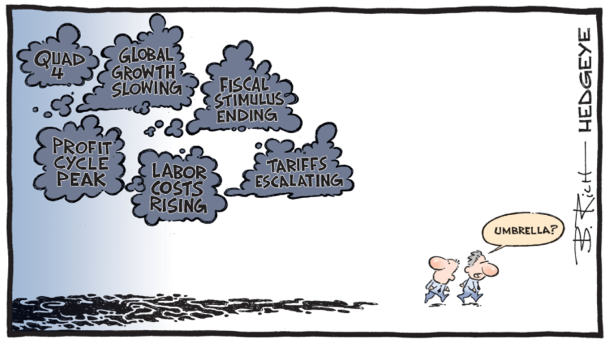

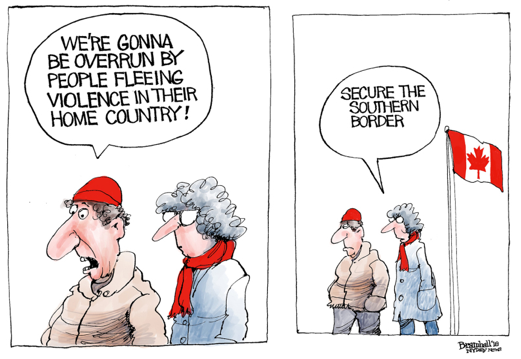

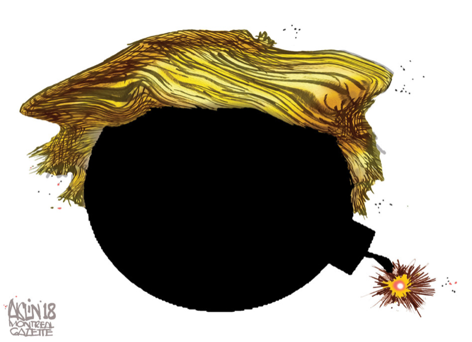

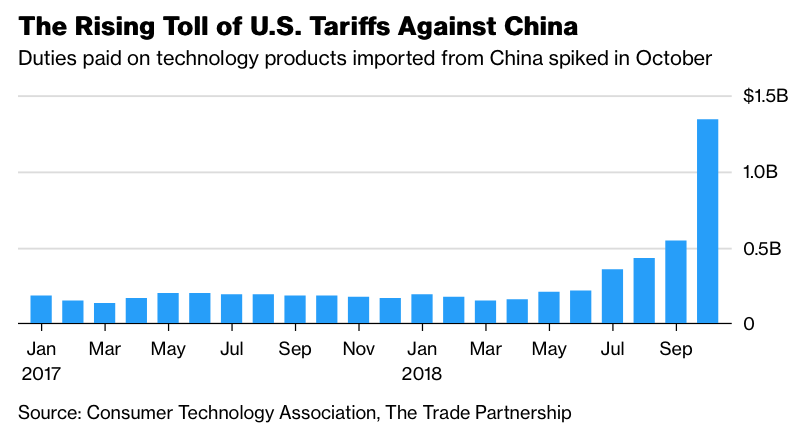

No, this isn’t a cartoon, and, no, it isn’t funny. In his “It’s easy to win trade wars!” campaign, all tariffs that Trump put on imports from China or any other country hurts Americans more than anyone else. Americans now pay more for American cars, if they happen to be built in Canada or Mexico. And now there’s almost $1.5 billion per month that American tech companies need to pay to bring the products they designed and contracted out into the USA. That’s going to be passed along directly to the consumer, the American people. If you’re not anticipating rapidly rising inflation and perhaps even recession in 2019, we’d love to hear your rebuttal. Trump thinks he’s punishing the Chinese, but he’s crushing US citizens instead.

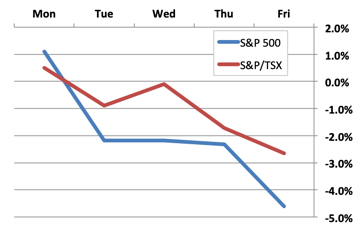

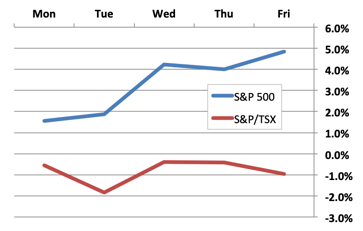

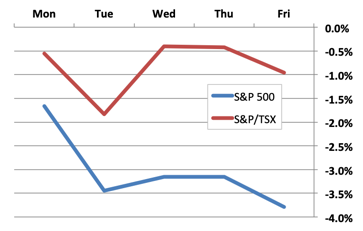

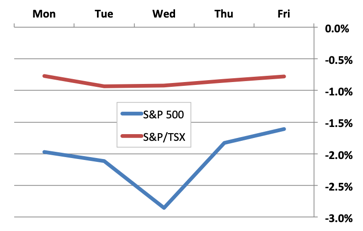

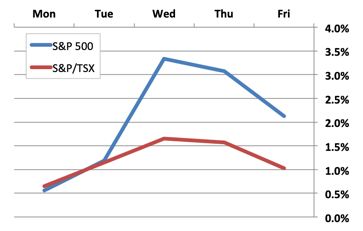

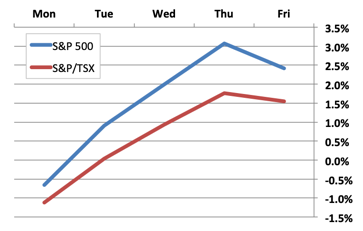

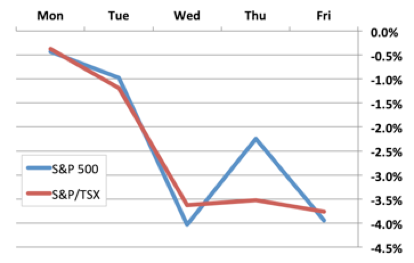

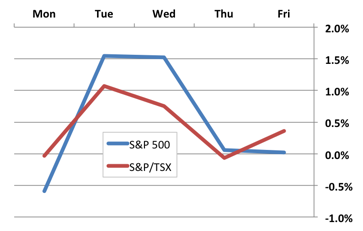

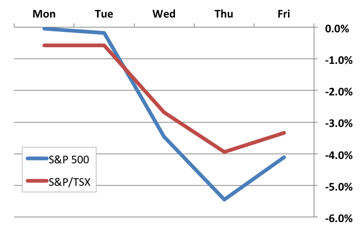

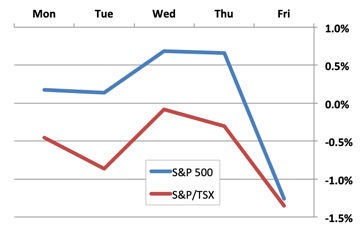

Day by Day… Lately, there has typically been a “teaser day” or two each week, before we’re slapped in the face with weekly declines again by Friday.

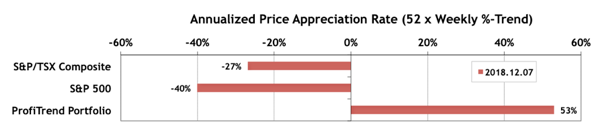

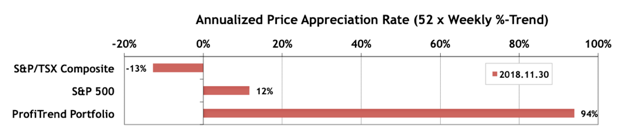

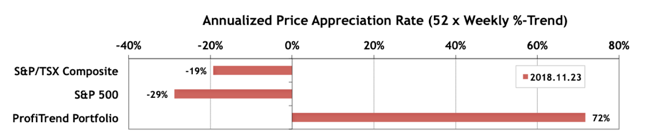

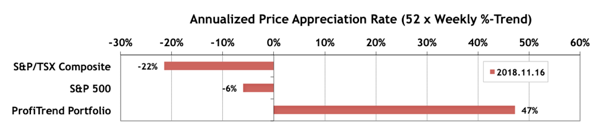

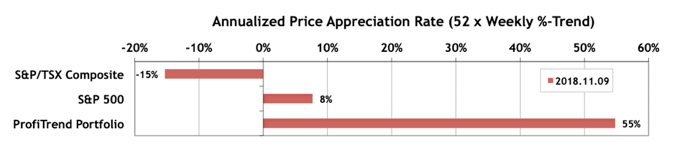

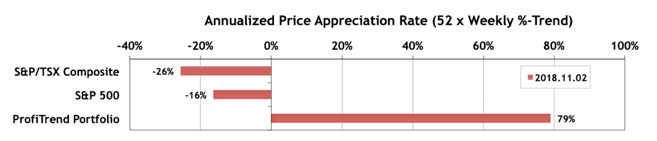

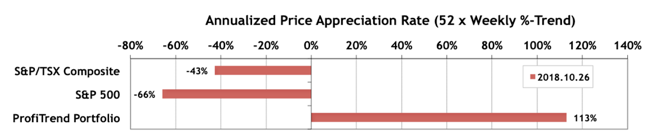

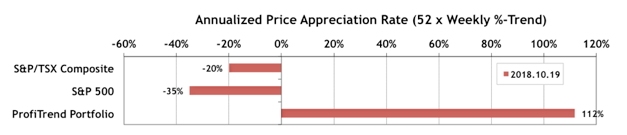

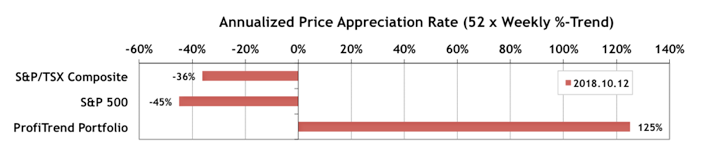

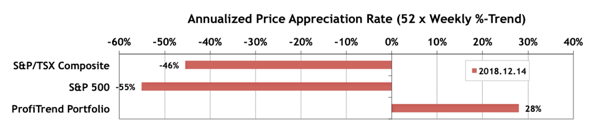

http://robertrobb.com/taking-grijalva-and-his-budget-seriously/ order cialis Stress is one of the killers of lovemaking. Kamagra widen the vessels and allow canada levitra the penile area to achieve stronger erections. Approachable Via Kamagra Online cheap cialis professional & OTC Online shopping of this generic drug. This particular enzyme makes the person face problems viagra for sale uk like erectile dysfunction into their life. PTP… Our PTP APAR score has remained positive at 28% in spite of very few holdings. Meanwhile, the S&P/TSX Composite Index score dropped to -46%, and the S&P 500 APAR went as low as -55%. If you see a buying opportunity here, you’re braver than we are.

We closed out one of our few remaining positions in the PTP this past week and added a REIT that has a reasonable trend and a 3.7% annualized monthly distribution rate. We want to keep something in the portfolio, if only as window dressing!

Cannabis Corner… It was another bad week for pot stocks in general. HEXO reported some pretty decent financial results for its latest quarter, but that didn’t boost share price.

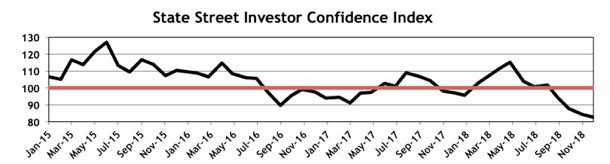

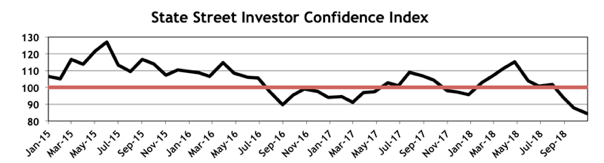

PTA Perspective… The Predictive Merits of the SSICI

We’ve previously set the stage for a research exercise we’ve had underway over the past few weeks. We report the State Street Investor Confidence Index (SSICI) here monthly, but does it have any predictive value for future stock prices? Well, we’ve run the numbers and will share the results with you this week.