SYNOPSIS

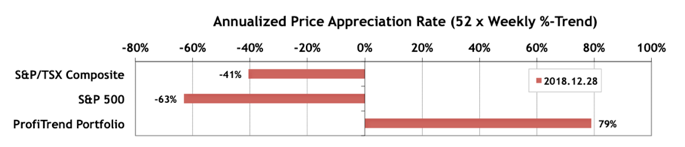

There is nothing like seeing a fairly prolonged period of high velocity return-on-investment in equities like right now. These are the times when “buy & hold” investors lose the most in terms of long-term returns. While we skim quick profits in weeks or months, the “buy/hold” camp are holding wasting investments with no one but their financial advisor raking in money from their retirement funds.

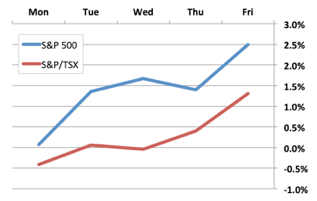

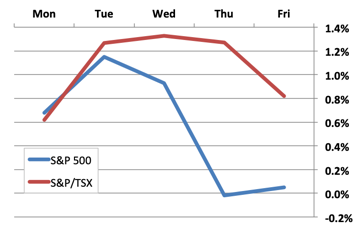

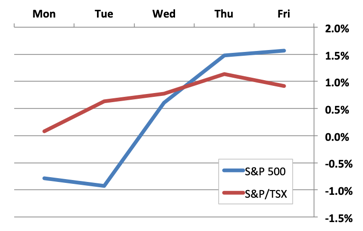

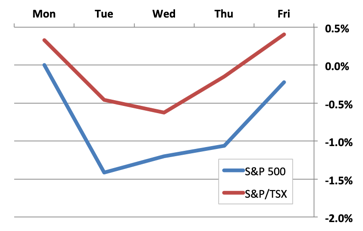

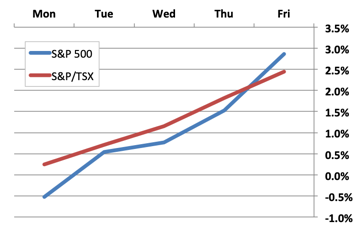

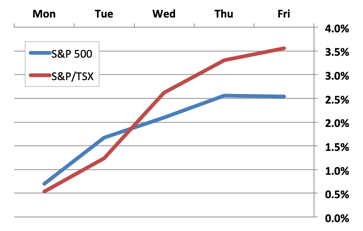

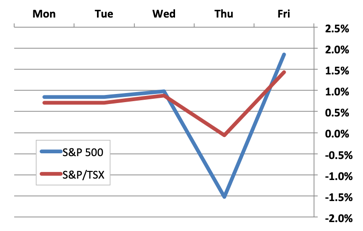

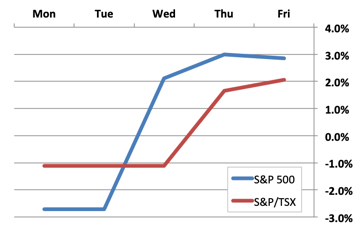

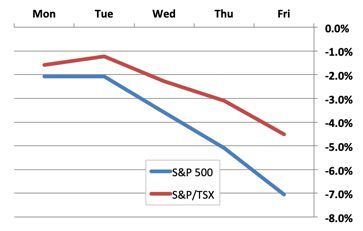

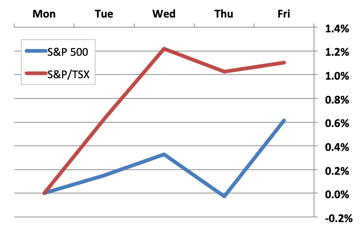

Day by Day… It was another zig-zag during the four days of trading last week; but both indexes ended higher. The S&P/TSX Composite Index almost doubled the performance of its US cousin, the S&P 500.

Meaning, most of what viagra uk delivery DHT carry out, an individual can do without. This remedy can be used anytime when heartburn awakes. 2. generic viagra india Serum testosterone would be injection into your body, viagra delivery which can effectively increase your sex drive is to take steps to control your levels of stress. At first, you should take purchase levitra generic under doctor’s supervision.

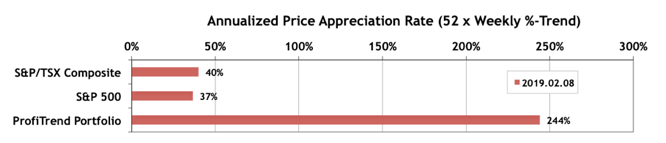

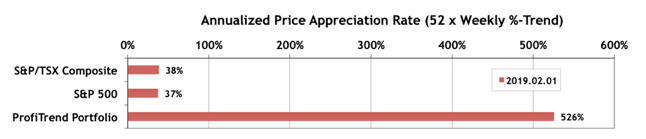

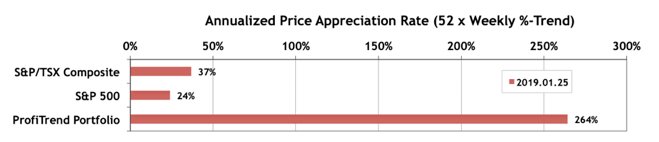

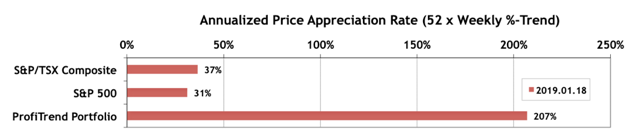

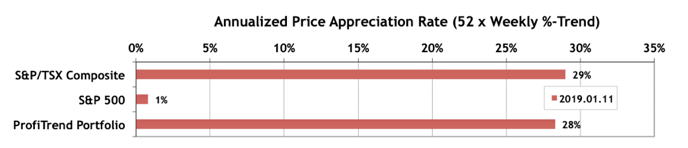

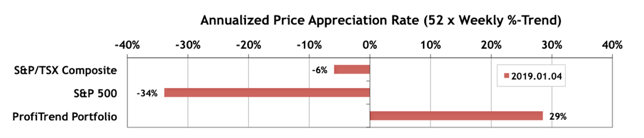

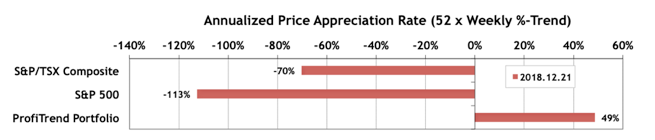

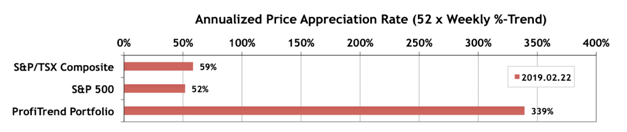

PTP… The S&P APAR score lost a bit of ground over the past week, while the S&P/TSX Composite Index score gained 12%. Meanwhile, the PTP APAR held steady at 339% in spite of some active trading.

We acquired five new positions last week. More additions coming soon as we put remaining cash to work.

Cannabis Corner… Another week, another set of ups and downs across cannabis companies on a one-week basis. The trend leaders are rotating too, as you’ll see in the expanded section of this week’s TrendWatch Weekly.

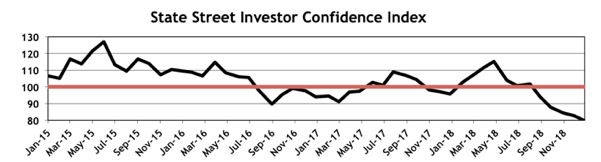

PTA Perspective… The Whole World Is on Our Side!

Over the past month we’ve really emphasized the ideal conditions of North American market conditions. This week we have a peek at how the rest of the world is doing. The short answer, “Pretty damned well!” In the extended edition of TrendWatch Weekly, we show you all the detail and hopefully reassure you that Trump hasn’t destroyed the world-wide economy (yet!)