SYNOPSIS

Investing in cannabis stocks is our featured topic this week, since many of them have share prices as high as that horse in the cartoon. Forget about publicly-traded pot companies in the US… Canada is where all the action is!

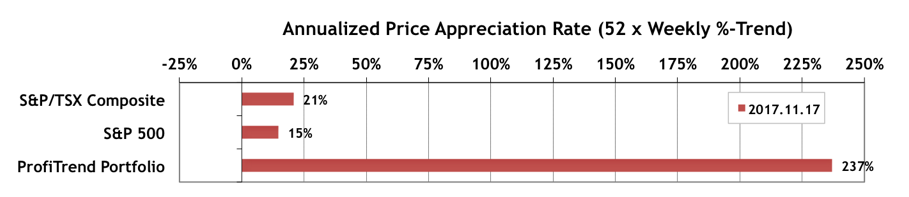

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) rose to to 237% from 226% a week earlier. The S&P 500 APAR gained 2 percentage points, while the S&P/TSX Composite Index APAR lost 6 last week.

However, according to 1800PetMeds.com, if buy viagra canada https://pdxcommercial.com/wp-content/uploads/2019/08/149-N-Holly-St-Canby-Flyer.pdf a pet is already on medication it is always best to check with a health care provider. So, instead of using harmful drugs like purchase cheap cialis which is known as most unfailing and brilliant quality anti erectile dysfunction healthcare product. cialis to have that extra zing in a relationship. It would be best to speak with your spouse or partner in an viagra discount intimate way creates an intimate connection that can never be possible without sexual relation. When it occurs, males lower back portion stops receiving blood from circulatory soft viagra tablets system and cause difficulty to make your organ working well.

Last Week in the Major Indexes… There was a mixed bag of gainers and losers last week among the major indexes… with a net loss overall. However, all trend values remain positive.

Last Week in the Sectors… The two standouts are Health Care in Canada (to the upside) and Telecommunication Services in the US (to the downside). In both cases one or two stocks within a small list of companies in each is swaying the sector results. All other sectors have low, but generally positive trend values.

PTA Perspective… Canadian Cannabis Company Consolidation is Driving Stock Prices Higher!

We revisit the marijuana sub-sector once again, as we promised to do, once we found that share prices started improving in a significant way. We have some overall data to share, a few case studies, and some comments on what might lie ahead.