SYNOPSIS

It’s official! The world’s largest company is now worth in excess of $1,000,000,000,000.00… yep, a trillion dollars US! Even more amazing is that with a P/E of just 19, Apple Inc is one of the cheapest large tech stocks out there! Compare with Microsoft (P/E= 73), Google (P/E= 52), Amazon (P/E= 232) or Netflix (P/E= 234). The price/earnings ratio, as you should know, is how much investors are willing to pay per share for $1 of earnings. At an Amazon multiple, Apple would have a market cap of over $12 trillion.

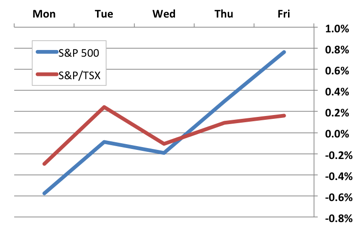

Day by Day… After a week or two of disappointing performance in tech stocks, Apple provided a much needed boost to the Information Technology sector mid-week. That also drove stocks in general higher through weekend. While S&P 500 stocks started weaker last Monday, by Friday they were higher for the week than S&P/TSX Composite Index equities.

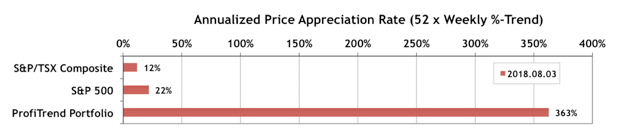

PTP… Our PTP APAR score advanced over the week. The S&P/TSX Composite APAR rose a couple points, as did the S&P 500 APAR. The PTP score has been above its seven-year median (of of about 100) for 15 consecutive weeks now.

As for trading in the ProfiTrend Portfolio, we sold we sold two holdings after sell signals.

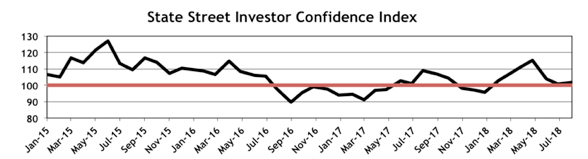

Investor Confidence… The July 2018 results for the State Street Investor Confidence Index (SSICI) arrived last week. The Global Investor Confidence Index increased to 101.8, up 1.0 point from June’s revised reading of 100.8. Confidence among North American investors declined, with the North American ICI decreasing from 104.2 to 103.4. Meanwhile, the European ICI rose by 0.7 points to 91.5 and the Asia ICI increased by 0.5 points to 103.3.

As usual we provide more detail on the regional ICI’s in the complete Investor Confidence section of TrendWatch Weekly.

PTA Perspective… Building Your Own Predictive Models for the Stock Markets

Relative trend analysis™ (RTA) has been designed in such a way that you don’t really need to forecast the future. You just go with the flow (the prevailing trends) until they end. But that doesn’t mean that you can’t experiment with other ways to make money… especially in times when there are relatively few solid trends to be found. Although the current market environment remains positive, it can’t hurt to plan for the future. Besides, do-it-yourself investors should always have some back-burner activities going. Reading about other strategies helps, but it’s definitely more fun to do some of your own research. In this updated edition of a piece I wrote several years ago, I offer some tips on building and testing investment models based solely on probability considerations. After all, the initial goal is predicting market direction. Everything else builds on that foundation.