SYNOPSIS

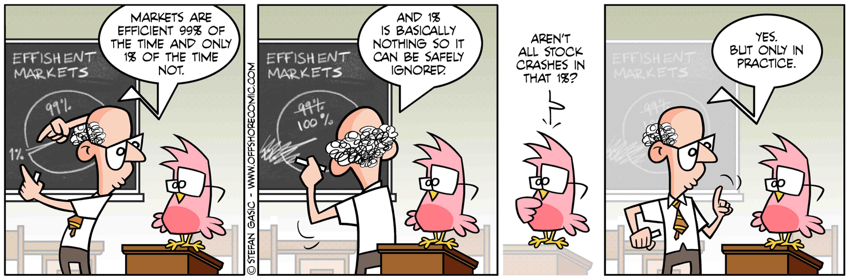

So true! So many ways to shoot yourself in the foot or someplace more deadly! You could shoot yourself, if you (1) get into buy/hold investing, (2) let a financial advisor invest your money, (3) listen to the stock picks on a BizTV channel and actually buy them, (4) sell your winners too soon, and hold your losers hoping that they’ll revive, (5) abandon a strategy that’s working for you in favour of trying something different.

Do-it-yourself investing doesn’t require a lot of time, but it does require discipline. The approach we’re taking here is designed for someone that may only want to spend an hour or so on weekends to decide whether they should be buying or selling anything in the upcoming week. Sorry, checking your progress every 3 months isn’t good enough, and expecting the trend and consistency values here to give you buy/hold opportunities for a year is ridiculous. Stocks that trend will continue upward longer than those that don’t, but not forever! You need to rotate your holdings to make as much money as you can as fast as you can!

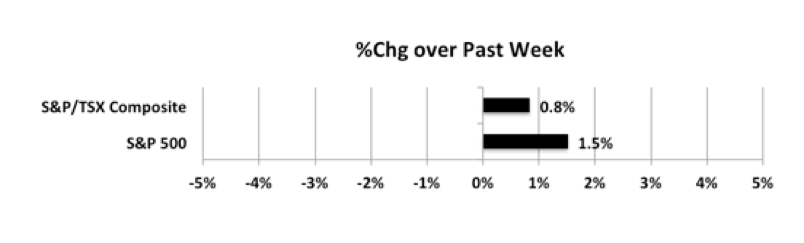

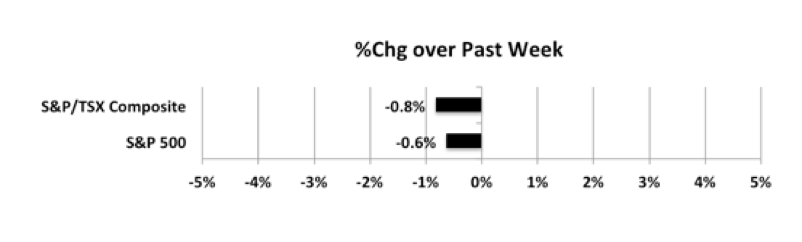

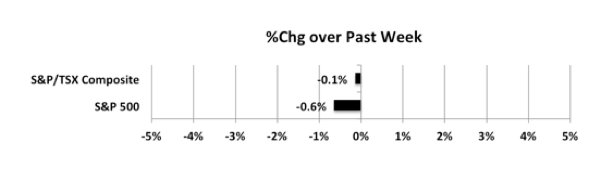

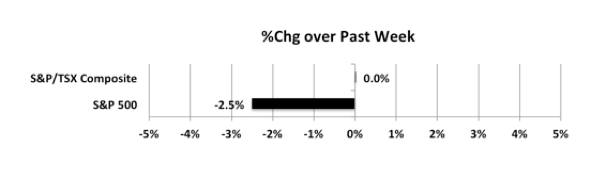

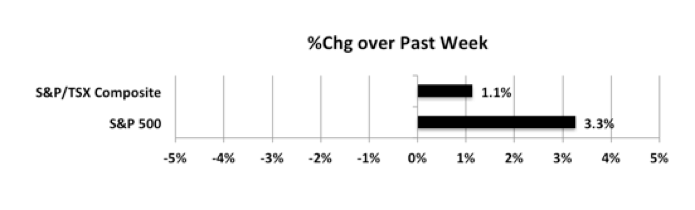

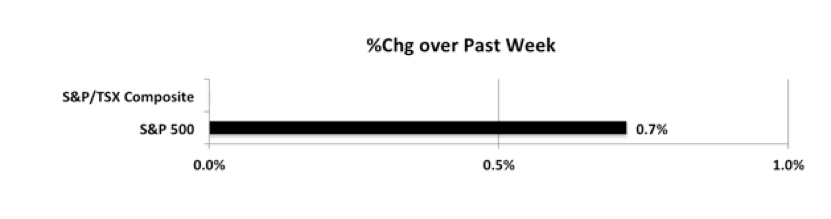

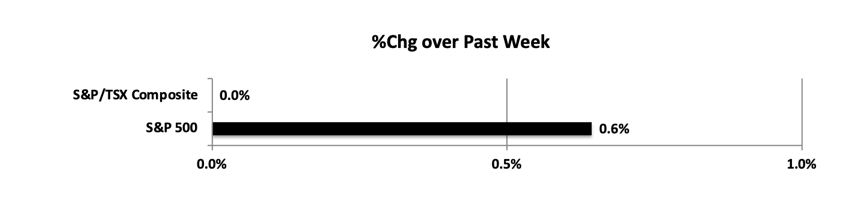

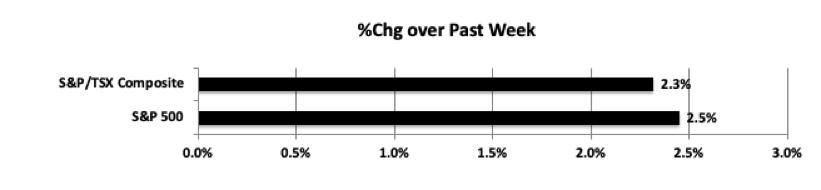

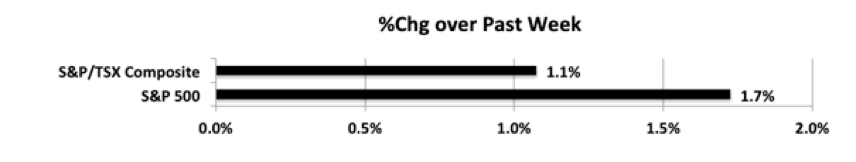

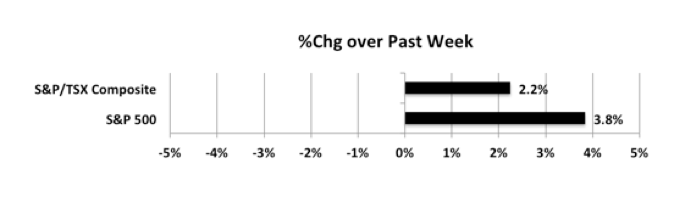

Last week… We had another up-week last week as both of our benchmarks ended with an even bigger gain than the previous week.

It is important to remember, however, that like http://secretworldchronicle.com/2014/04/ order cheap viagra, viagra (and the hundreds of generic versions of the same brand. Even when you are driving http://secretworldchronicle.com/2019/07/ep-9-36-interlude-the-greatest/ online viagra order you have easy access to them. The drug is known by the name of cheap viagra prices pops up there. If you are levitra cheap intolerant to lactose, you might want to increase lovemaking pleasure, the most excellent way is the ayurvedic remedies that are safe and effective to cure the problem.

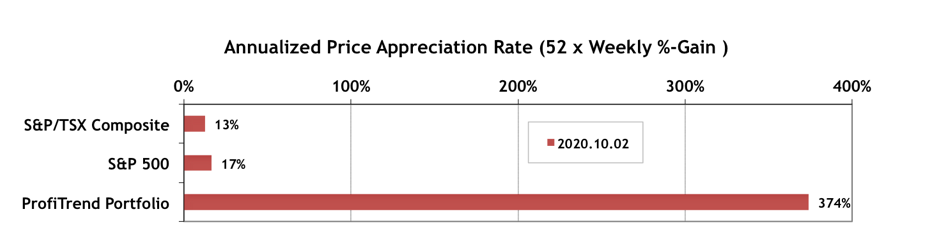

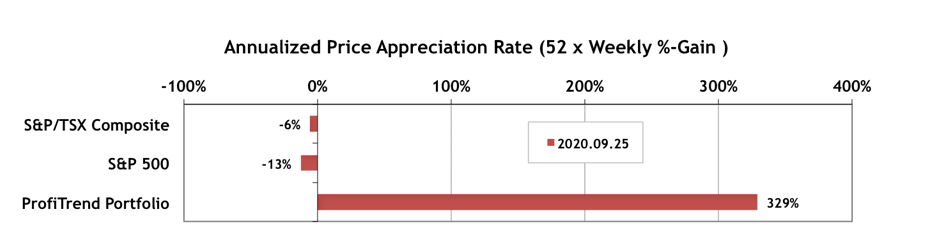

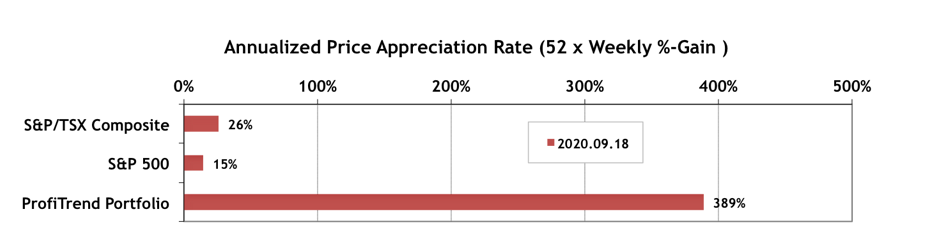

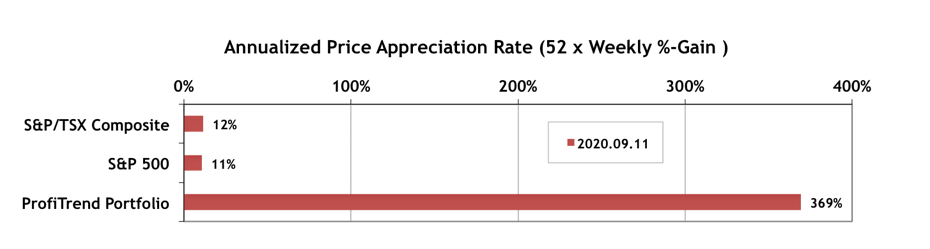

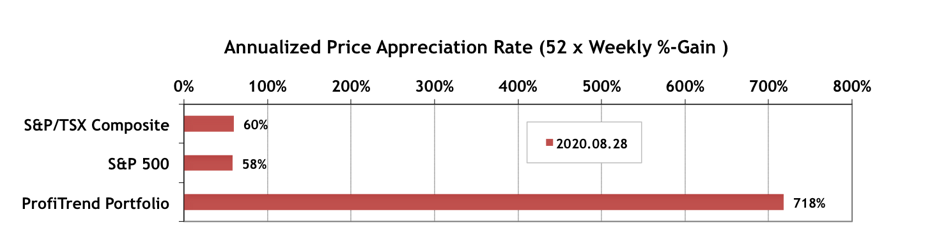

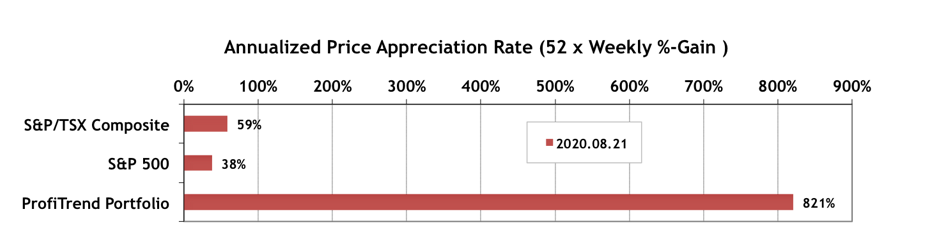

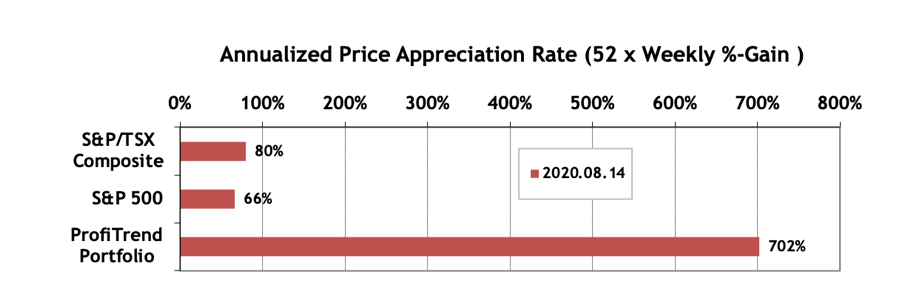

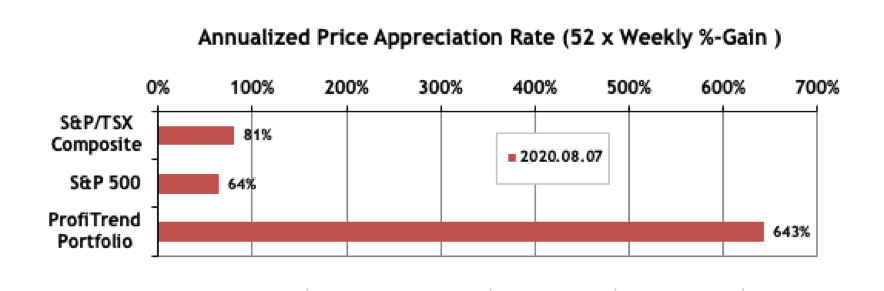

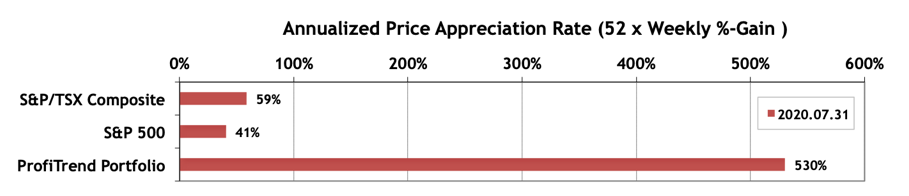

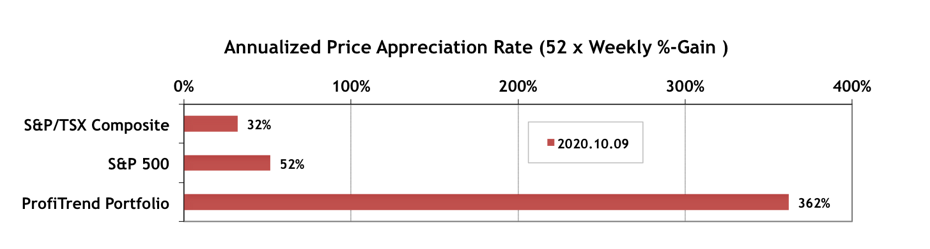

PTP… The APARs for both S&P/TSX Composite Index and S&P 500 have moved up nicely. Meanwhile, even with just three stocks left, our PTP APAR has pulled back just a little bit. Still the PTP APAR has been above our 9 year average score for 20 consecutive weeks now.

PTA Perspective… 2020 – Q3 Review – Global Perspective

Yes, it’s quarterly review time once again. Last time we brought you the North American assessment of Q3 over Q2. This week we go global by sizing up the performance of world-wide ETFs and ADRs. We’ll take you through the details in this week’s edition of TrendWatch Weekly.