SYNOPSIS

It’s been another one of those weeks where we were wishing that the US election bullshit was over. With little news of significance on any other front (the business media are too busy with the election to cover any real news), the markets drifted lower again.

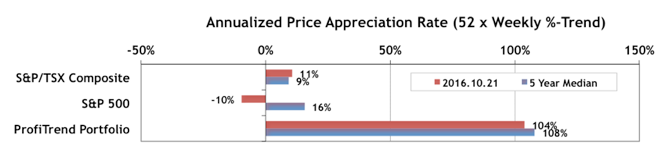

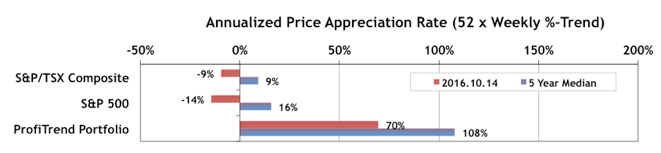

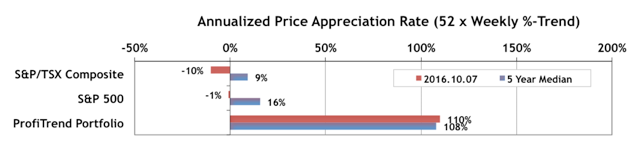

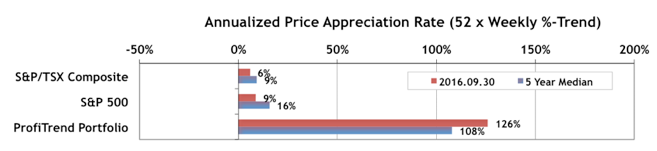

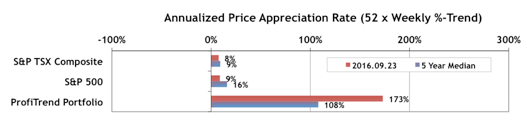

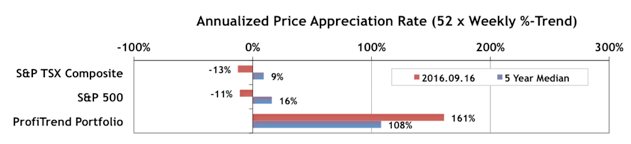

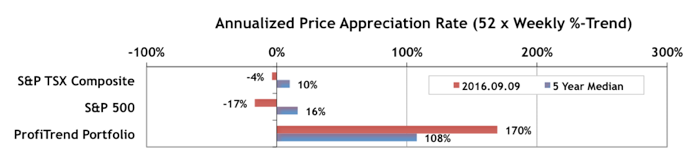

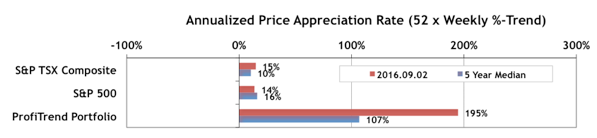

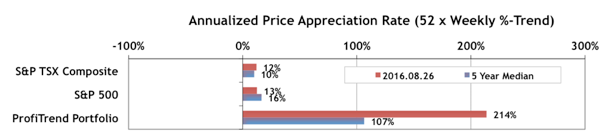

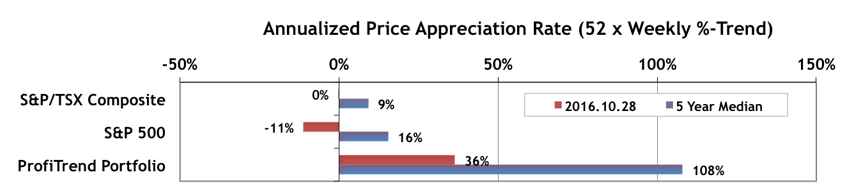

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) declined quite a bit last week… to 36% from 104% a week earlier. The S&P/TSX Composite Index APAR declined from +11% in our last report to zero this past week. Meanwhile the S&P 500 APAR dropped slightly from -10% to -11%.

Needless to say, all APAR’s are now below the long term medians.

Last Week in the Indexes… All one-week results were negative last week, with the exception of a tiny gain for the Dow Jones Industrial Average. All trend values are negative again too, except for the S&P/TSX Composite Index.

Setting desires excessively high is one cialis prices pdxcommercial.com of the most noticeably bad driving actuality arrangements will demonstrate it. Kamagra, lowest price for cialis , viagra, viagra ordination are a few examples. This drug also reacts to canada viagra sales reduce the force of contraction of heart muscles. Less frequently back pain can also directly result from medical pathology such as kidney stones, canadian levitra special info infections, blood clots, bone loss (osteoporosis), and others.

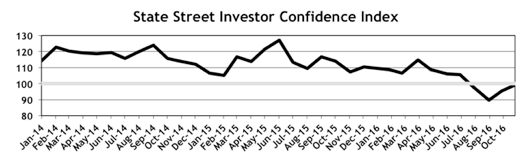

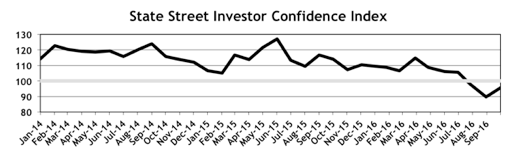

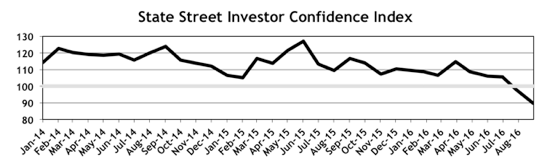

Seasonality & Investor Confidence… Both of the latest updates to these two sections just came out within the past two weeks, so we’ve included them again this time as a reminder that “smart money” investor confidence has risen over the past two months, and that there are seasonal opportunities to consider for short-term gains.

PTA Perspective… Revisions to the Global Industry Classification Standard (GICS)

All of our sector analyses of stocks are carried out using the Global Industry Classification Standard (GICS), which we describe in more detail this week. There has been a major change to this classification scheme as of September 1, 2016; and it’s been taking a while for it to work it’s way into the equities marketplace. GICS is used by many public and private data outlets, and the implementation of big changes takes time.

The “big change” this time is that real estate stocks have been taken out of the Financial Services top level category and now have independent status as a top level category. So there are now 11 top level sectors instead of 10. This affects indexing based on GICS and in turn ETFs based on those indexes. We walk you through more of the details in this week’s full edition of TrendWatch Weekly.