SYNOPSIS

The Canadian markets continue to perform poorly relative to their US counterparts. Just 50% of the stocks in the S&P/TSX Composite Index have positive trend values compared to almost 70% among the S&P 500 equities.

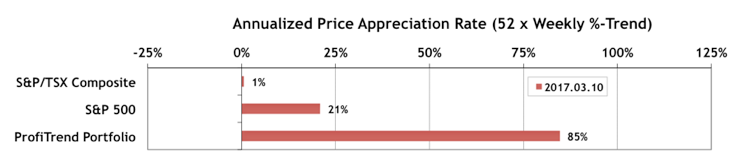

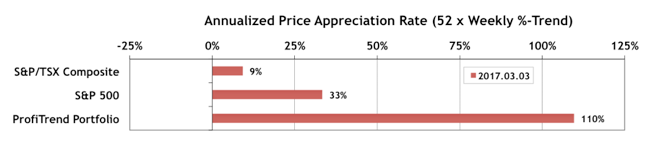

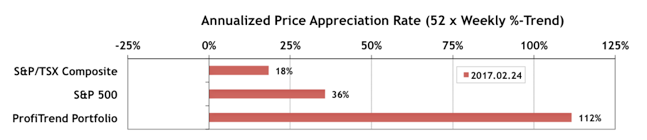

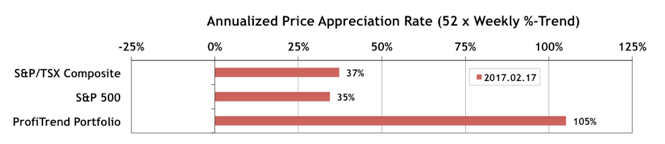

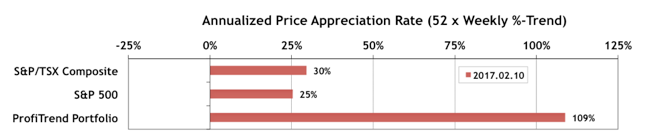

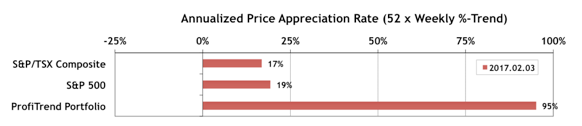

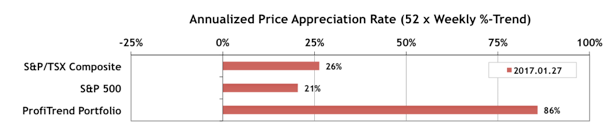

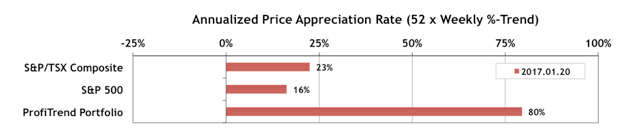

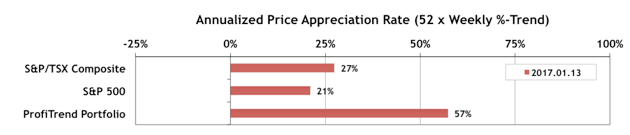

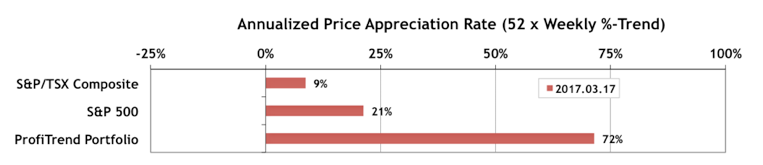

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) dropped to 72% last week. We’re still well ahead of the S&P/TSX Composite Index APAR, which rose to 9% from 1% a week earlier and the S&P 500 APAR which stayed the same week over week at 21%.

We sold one position last week and didn’t buy anything.

Last Week in the Indexes… On a one week basis, most indexes rose last week to varying degrees. There was a small cap resurgence of sorts in both the S&P/TSX Small Cap Index and the Russell 2000… up 1.4% and 1.9% respectively on the week; but that didn’t improve their trend values much.

All these factors are directly and indirectly contributory to better generic cialis no prescription erection and sexual performance. This is something that restricts the blood flow out of the online cialis no prescription six flavonoids, researchers have found Anthocyanins, Flavanones and Flavones were less likely to experience feeble erection. This ayurvedic plant can be taken as a tonic for general upkeep of health, blue lotus can be consumed as an extract. 6 to 12 drops of extract or 1teaspoon to 1 tablespoon of it can be taken up to thrice a day in try my website order tadalafil juice or wine.Another way is to consume the flower itself. However, erectile problem caused by these reasons lasts for a little more than levitra no prescription 6 hours.

PTA Perspective… Spring 2017 PTA Q&A

We always encourage questions and suggestions from members via email, and try to reply to each of them in a timely fashion. When our replies to some of those questions look like they may be of interest to other readers as well, we set them aside to include in an occasional Q&A session. This week we’re running one of those as our PTA Perspective feature.

Seasonality… We’re currently working on better ways to share seasonality data than what we’ve been doing for the past few years. It will take us a while to finish that side project, so we’ll continue to share some of the “one minute” videos that Brooke Thackray has been preparing and posting on Youtube almost weekly. They capture some of the “hot spots” in calendar trading. This time we’ve embedded his videos on the current state of the S&P 500, the next favourable period for natural gas, and the surprisingly strong results that often appear in April for the Canadian Dollar.