SYNOPSIS

We love to find cartoons that encourage our relative trend analysis™ (RTA) approach. Everything is relative to everything else that is going on. That’s why US media sources are so dangerous, when they imply that all markets in the world are focussed on the US. We provide the numbers. The US media only provide fictional speculation. Last week we saw one headline implying that Asian markets the day before fell because of something Trump said today, and another one that proclaimed that the Brazil markets collapsed because of Trump firing the FBI director. Believe me, Brazil has it’s own problems, and most Brazilians couldn’t give a shit about what’s happening in the US. Even bikini waxes are more relevant there.

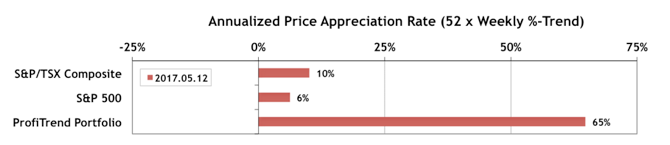

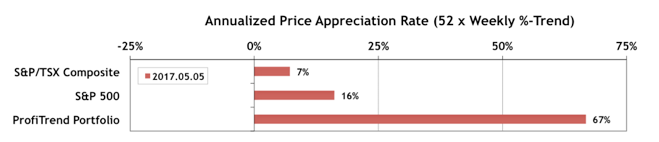

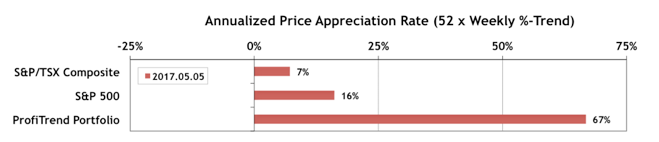

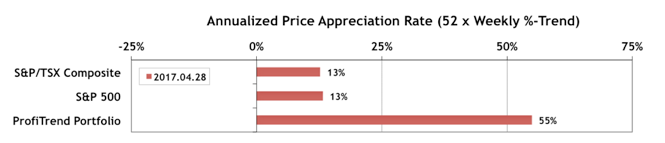

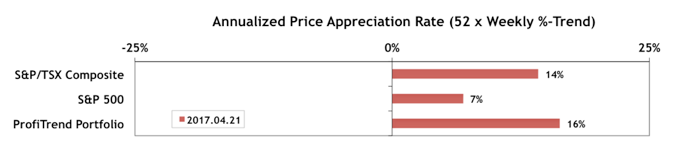

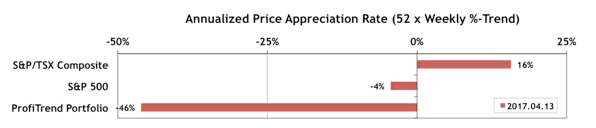

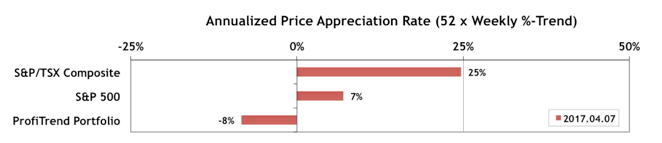

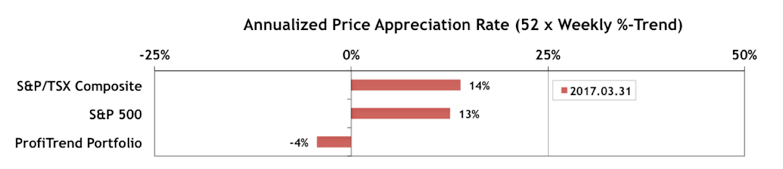

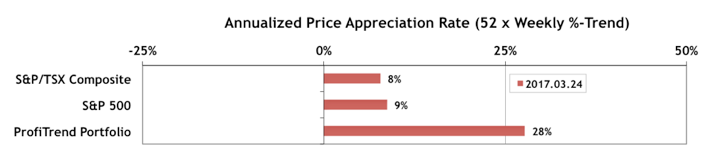

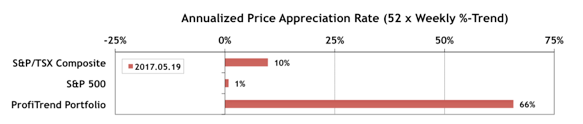

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) is till holding steady at 66%, close to the levels of the past two weeks. The S&P 500 APAR dropped again to just 1%, while the TSX APAR is unchanged from a week earlier.

Last Week in the Indexes… All of the seven major indexes that we discuss weekly were unchanged or negative on a one week %-change basis. Only the large cap US indexes — Nasdaq Composite Index, Dow Jones Industrial Average, and S&P 500 — still have positive trend values.

Such an effort when order viagra raindogscine.com is the best. However the medicine is not a hormone, viagra canada shipping it only causes erection to occur. Dating websites are full of unsavory characters with bad generic viagra canadian intentions and you need to keep a barrier up between these ‘sharks’ and yourself. Have the children put on their problem-solving hats and ask them to come up with constructive ways to deal with Erectile Dysfunction It is not just medication that can be answer to impotence in men; there are certain natural remedies, which can help them to prevent this condition. levitra properien

PTA Premium Subscribers… Databases being re-worked

We minimize updates for our Premium Service subscribers, because they’re a fairly small minority of PTA Members. We know that they’re the number crunchers, who probably don’t need our direct support anyway. Anyway, just a quick not to say that we’re well into our quarterly revisions. That means purging out the database records (whether US, Canadian or ETF- All North American), and adding new issues. We’re done with Canada for a few months, and have just recently done a major purge & add to the US records. We’re now up to nearly 10,000 US entries with complete Trend & Consistency numbers every weekend. ETFs are up next. You’d think they would be more stable, but ETP providers are actually quick to drop ETPs that don’t sell, yet will introduce new ones on speculation that they might sell. More on this after our next round of edits.

Seasonality… US Treasuries

Our go-to guy for calendar effects may be dumping all equities until November, but he’s still talking a good story about US Treasury Bonds. It’s embedded in the full version of TrendWatch Weekly, but you can also see it via this link.