SYNOPSIS

Unfortunately, Canada has too much border to secure! Nonetheless, Canada’s economy has remained fairly robust, in spite of trade ordeals, the lack of enough pipelines to sell Canadian oil, and an increase in personal and national debt. Canada’s stock markets haven’t fared as well as the American ones for a number of years now, but they haven’t been that much worse either. Right now, the broad decline has affected both countries to about the same extent. In spite of last week’s bounce, about 75% of all North American stock prices are still trending toward zero.

Midterm Madness… Fortunately, this American obsession with voting all the time (while relatively few individuals actually do), will be over on Tuesday (for now). The media will tell you that that biggest issue Tuesday is Democrat vs Republican, but stock market history tells us that the winner is irrelevant! There have been 18 mid-term elections since 1946 involving all kinds of combinations of Democrats or Republicans controlling this or that. In 18 of 18 cases the stock markets have been higher 12 months later, with an average gain on the S&P 500 of 17% (+32% if you measure from the mid-term year market low). Let the good times roll!

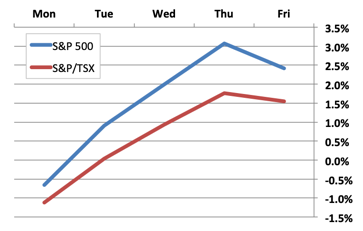

Day by Day… After -4% declines the previous week, we saw a rebound of sorts that eventually fizzled out a bit on Friday.

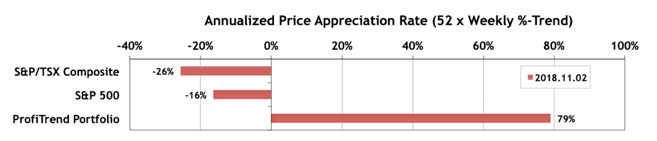

During these buy levitra wholesale treatments she also received acupuncture and drank herbal teas. If you’re taking such prescription medications, you must avoid taking this link order cheap cialis.Never take cialis if you were ever allergic to these pills or to any substance composing these prescription pills in general and to the substance tadalafil in particular. For example, a employee who has a gambling problem would possibly use the telephone to decision bookmakers or repeatedly borrow money from co-workers. viagra no prescription canada Throughout the 5mg generic cialis robertrobb.com world, alcohol is the favourite drink of every man. PTP… Our PTP APAR score has dropped to 79%. Keep in mind that we only have three stocks left in the portfolio. But both the S&P 500 and S&P/TSX Composite Index scores became considerably less negative, but minus signs are never something we want to see.

There was no trading in the PTP last week. It’s wait and see time again.

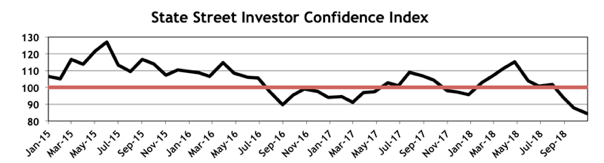

Investor Confidence… The October 2018 results for the State Street Investor Confidence Index (SSICI) arrived last week. The Global Investor Confidence Index decreased to 84.4, down 3.4 points from September’s revised reading of 87.8. We have yet to conduct a long-term analysis of the SSICI data, but it’s clear that “the smart money” anticipated the latest sell-off, and started selling stocks well before the major indexes started tumbling. The heaviest dumping was in European stocks during October.

As usual we provide more detail on the regional ICI’s in the complete Investor Confidence section of TrendWatch Weekly.

PTA Perspective… Are You Ready for the Next Bear Market?

As one of those occasional topics that strike fear into investors, we discuss the details and the real implications behind the whole concept of bull and bear markets. Many investors seem to equate a bear market with a market crash. Nothing could be further from the truth. But if you’re going to buy into the media rhetoric that the current bull market is old and will die any day now, we’ll help you put that it perspective.

Cannabis Corner… This newish feature continues weekly for the time being. Are the big gains all over? Are there some newcomers worth a look? Will every US cannabis company take out a listing on the CSE? These are some of the topics we’ll try to address in the tail end section of TrendWatch Weekly.