SYNOPSIS

By now, just about everyone knows about Bitcoin… the so-called “cryptocurrency” that is not bound to any country or economy. It is it’s own entity. Transactions are highly automated, yet it still fluctuates in value relative to other real currencies. There are some advantages to holding some Bitcoin, as you would hold cash or gold, in addition to your stocks and bonds. This week we review the recent rapid appreciation in the value of Bitcoin. Perhaps there’s room for some cryptocurrency in your portfolio. Look for more on this in our Featured Chart section.

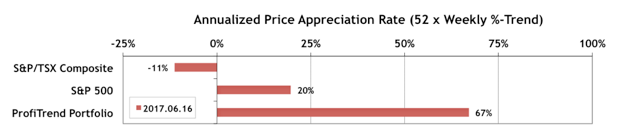

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) dropped just a point from last week to 67%. The S&P 500 APAR held steady at 20%, but the S&P/TSX Composite Index APAR fell dramatically to -11%.

Last Week in the Indexes… The major Canadian indexes continue to trend lower. Among the US counterparts, Nasdaq continued to lose ground. The Dow Jones Industrial Average is now the trend leader among the seven major indexes that we track.

Seasonality… While our calendar effects expert keeps reminding us that we’re in the unfavourable six-month period for stocks (May-Oct), he is also good enough to point out the periods during the unfavourable period, when specific sectors and sub-sectors tend to outperform. Late June through mid-September are looking good for Biotech. More on that in the complete edition.