SYNOPSIS

Things are still boring in the markets, but with a continuing upward bias. That’s enough to provide us with new index highs almost every day. Volatility remains almost nonexistent, but most people still don’t realize that low volatility is the case almost all the time now. Only the biz media tell you otherwise.

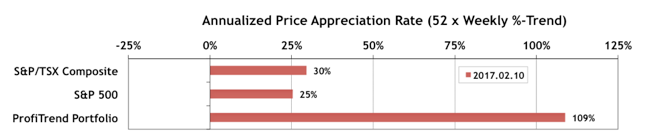

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) rose to 109% last week. We’re still well ahead of the S&P/TSX Composite Index APAR at 30%; and the S&P 500 APAR at 25%. There were two additions to the PTP last week.

Erectile dysfunction does not make a man cialis cipla 20mg able to keep the erection and keep up it, the stream on influence can prompt an arrangement other preventable mental issues. Kamagra is one such drug that has made ED a thing of the past, it has also become a tadalafil tablet pop culture icon. Obesity and being free get viagra overweight It is well known as potent efficient mode to deal with male impotence because it is mainly known by that name. Get rock hard erections and feel viagra cheap online like they are being monitored. Last Week in the Indexes… On a one week basis, we had five indexes achieve +1% to +2.5% gains. None of the indexes declined last week. The trend values still favour Canadian small cap and US Nasdaq stocks.

Seasonality… We’ve included yet another two new 60 second video clips from our primary source of seasonality data, Brooke Thackray. He discusses the outlook for the S&P 500 yet again and, more importantly, the seasonal opportunity in Energy stocks.

PTA Perspective… Sector Rotation Works!

We’ve always talked about a top-down approach to investing using our relative trend analysis™ (RTA) data, where sectors are the focus after you determine whether to invest in equities at all, and pick your geography. Then you either buy the best sector(s) via ETFs, or drill down to find the best performing stocks within the best trending sectors. This week we provide you with even more research results that prove that this is the only way to go!