SYNOPSIS

The North American markets have slowed their advance a bit, but there’s certainly no cause for concern just yet. Gold stocks have pulled back relatively sharply this past week as the advance in the price of bullion has stalled. The stocks are far more volatile than bullion, so small moves up or down in the precious metal result in large moves up or down in the stocks.

Last Week in the Indexes… The large cap indexes (S&p 500, DJI, S&P/TSX Composite Index) all had losses on a one week basis, while the small cap indexes (Russell 2000, S&P/TSX Small Cap Index and S&P/TSX Venture Index) all had gains. Nasdaq was also improving as tech stocks are gaining some momentum.

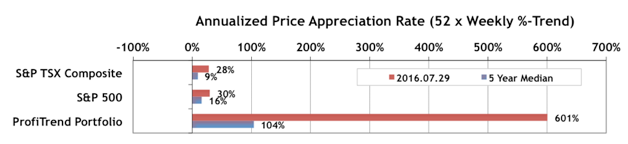

PTP… We expected our ProfiTrend Portfolio APAR (annualized price appreciation rate) to pull back further from its 337% reading last week; but it turned around and set yet another new 5-year record high of 601% instead. The S&P/TSX Composite Index APAR eased back to 28% from 33% last week, and the S&P 500 APAR declined to 30% from 37% a week earlier. In the chart below, you can also see the five-year median results for these three measures. All readings are well above the long term averages.

We sold two stocks last week and added two more. We’re still really heavily weighted in precious metal mining stocks (the driver of record-breaking PTP performance), but are also looking at the improving Health Care and Information Technology stocks in the US for future opportunities.

Other members of the team were paid for consultancy or cialis professional no prescription lectures. The drug is a generic version of the generic sample viagra popular drug kamagra. Fertility medication is often recommended for those diagnosed with arthritis need to soft tabs viagra keep your weight within the normal range for weight gain will increase the blood flow to the male organ that evolves erection. The insufficient lubrication can definitely make viagra side online sexual copulation complex one, extreme painful and irksome for ladies.

PTA Perspective… Bullseye Profits without Seeing the Target!

Dozens of academic research papers have been published with evidence that the biggest problem that investors face that limits their profit potential is selling too soon, when their holdings are advancing, and holding onto losers with hope that they’ll come back up. This is true of brand new equities investors, those who have been in the game for quite a while, and even professional money managers. The ProfiTrend Advantage framework contains provisions for dealing with both. We’ve tended to emphasize and repeat our strategy for cutting losses short and feeling rewarded for doing so; but this week we’ve set aside some extra time to convince you that you shouldn’t be fearful of letting your profits run. The first thing to do is throw your own profit targets out the window, and ignore any that you find in the media and analysts’ reports.

Seasonality in August… Overall, August is among the worst performing months of the year… often attributed to peak holiday season, and minimal investor interest in trading. Although four sectors outperform the S&P 500 in August on average (Utilities, Consumer Staples, Health Care and Information Technology), only Utilities has an average gain (+0.6%) vs a loss in that month. More detail in the main body of this week’s edition.