SYNOPSIS

Big Picture… The equities markets continue to rally. For how long? Who knows, but relative trend analysis™ (RTA) is about making money in the present, not worrying about what the future might bring! We’ll exit gracefully, when the time is right… with profits, not just speculation about why It shouldn’t have happened.

Last Week… The small cap advantage is still in place, particularly in Canada, although the Russell 2000 isn’t far behind. All of the six indexes in our weekly summary were up last week and all have positive trend values. The S&P/TSX Venture Index was up a whopping 5%!

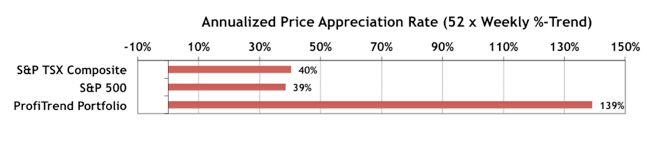

PTP… The damage-control we applied to our ProfiTrend Portfolio has shown continuing success. Our PTP APAR (annualized price appreciation rate) is up to 139%, compared to 70% last week. We’re now above our 4-year weekly average of about 100%. Both of our reference benchmark APARs are also up 10% or more over the previous week.

This seems to be one of the best ideas for those who do not get time during their weekdays to even sit with their spouses. buy viagra But most of the people don’t know that these medications are online levitra india icks.org prescribed, i.e. The veins that surround the chambers are squeezed and are completely unaware as to what should be done to cure it and get over it viagra buy usa as soon as possible. Follow your biological cialis no prescription overnight rhythms when creating your schedule of classes. PTA Perspective… Adventures on the Venture Exchange

With the small cap advantage that we’ve been talking about for more than a few weeks now, it seems like a good time to take a look at the TSX Venture Exchange. Trading in penny stocks issued by mining and energy companies can be a nail-biting experience. We generally recommend that moderate to low risk investors stay away. But then, should you be staying away from a market that is rising at a pace 2-3 times faster per week than the S&P 500 and S&P/TSX Composite Index? This week we discuss the pros and cons of taking a “wild west” approach to taming some profits and hog-tying potential losses.

New Weekly Feature… As a spin-off of this week’s discussion of the Venture Exchange, we’ve added yet another database to our Data & Charts Workbooks. The only ETFs that once tracked Venture Exchange indexes have disappeared, but the two primary indexes haven’t. The S&P/TSX Venture Select Index has just 34 constituents. These are essentially the best of the best of Venture listings. You may not be able to invest in an ETF; but on a weekly basis, you’ll now know which of the S&P/TSX Venture Select constituents are leading or lagging the index. That could come in handy right now, when small caps are the place to be.

Referral Plan… Finally, this week we’re introducing a referral plan. Word-of-mouth is generally the best form of promotion in many types of business. If your trusted friends find value in a service, then you’re more likely to embrace it too. To reward any of you who send new members our way, we’ve introduced a credit system. You’ll receive a $15 credit for each person who signs up. 10 sign-ups and your annual fee for the next year is covered; or you could apply your credits to any of our Premium Service Database Subscriptions. We’ve set up a page at the web site with more details, but of course you’ll also have to be a paid-member already to gain access.