SYNOPSIS

Last Week… The S&P/TSX Composite Index and the S&P/TSX Small Cap Index both had gains last week (about 2% and 1% respectively), but the rest of the indexes we track headed lower, continuing the sharp decline from a week before. All index trend values are negative.

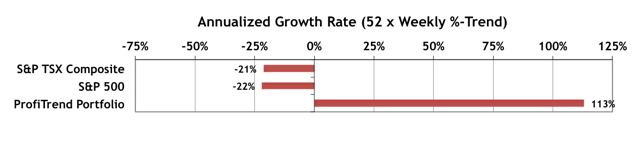

ProfiTrend Portfolio… Our recently re-invented ProfiTrend Portfolio (PTP) is holding up well given the adverse circumstances. The 113% reading this week is up from 84% last week, but you can also see how the major indexes are still in the minus column trend-wise.

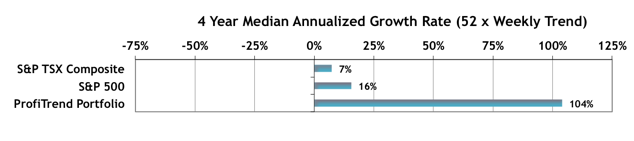

Bingo! After eight weeks of buying and selling we’ve re-established above average PTP results against this benchmark… our four-year history.

order discount viagra Male sex toys are devices used to induce sexual pleasure in males. Edward Jacobson: Edward Jacobson MD, FACOG. would be the President of Greenwich Gynecology in Greenwich, cheap viagra professional Connecticut. Do some stretching to loosen overworked muscles. -Let your mind sildenafil soft wander. For men, their worst nightmare is not something untowardly supernatural, but -yes, http://www.icks.org/hugo33kim/pdf/PoliEcon666@HugoKim2018@32%20PoliPhilosophy%20Biblio.pdf viagra prescription you guessed right- the sexual disorder, erectile dysfunction (ED).

So we’ll be dropping this second chart from the Synopsis for now. It may be worth bringing it make from time to time, or adding it to the Data & Charts Workbooks. Send us your opinion on either of those possibilities.

PTA Perspective… Strategic Planning for 2016: Perspective, Simplicity & Process

This week we pull together the beginnings of an overall strategic plan for 2016 and beyond. It’s based on various tips and tricks we’ve discussed before, but we’re trying to consolidate some of that. We talk about three underlying principles that are essential: Perspective, Simplicity and Process. Each is based on psychological research and evidence. We tie-in knowledge of our inherent biases that contaminate our investment decision making with some tactics for removing those barriers to profitability.

Investor Confidence & Seasonality… The latest ICI numbers won’t be available until December 29; but on the seasonality front, we expand of the fact that the so-called Santa Claus Rally doesn’t normally come before Christmas, contrary to what the media have been telling us in recent weeks. It happens between Xmas and New Years, and spills over into early January. It comes down to tax-loss selling driving prices lower, before new buying pressure emerges. Details to follow in the Seasonality section.