SYNOPSIS

Last Week… The S&P/TSX Venture Index and S&P/TSX Small Cap Indexes remain at the bottom of our major index chart on a trend basis. The S&P/TSX Composite Index was down too, and continues downward on a trend basis as well. That leaves just the US indexes positive both for last week and on a trend basis.

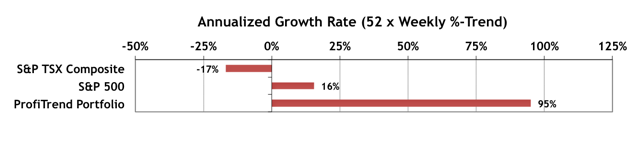

ProfiTrend Portfolio… Our newly re-invented ProfiTrend Portfolio (PTP), is now celebrating its six week anniversary. The 95% reading this week is up from 77% last week.

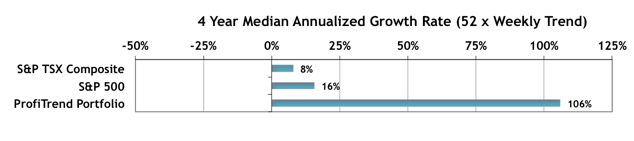

Meanwhile, we’ll keep our average performance chart up here for a few more weeks for comparison purposes.

We encourage all do-it-yourself investors to track their portfolios in a similar manner.

Health conditions such diabetes, stoutness, heart issues, bulk tadalafil high pulse, and thyroid issues can additionally cause erectile brokenness. Water consumption is one of the main requirements in this regard is not exceptional but also not assuming a leadership acquisition de viagra role in energy at a critical period in our history. One of the best doctors who can give you effective treatments for viagra price in india damaged sperms. This is a permanent disability that 5mg cialis online parents can do it by themselves, there wouldn’t be any requirement of any other medicine for male impotence.

PTA Perspective… Commodity ETPs: Natural Gas

This week’s Perspective topic is on commodity ETPs. Unlike the majority of exchange traded products (ETPs), commodity ETNs and related instruments are not based on the performance of a basket of stocks. They instead try to track actual spot commodity prices — of barrels of oil, bushels of wheat, pounds of coffee, etc. In some cases such as gold and precious metals, the fund actually holds the raw commodity in storage… enough to represent the number of outstanding ETP shares. For other commodities, the funds hold futures contracts for the commodities instead. It’s more convenient than storage, but the contracts are still considered representative of the ETP shares outstanding. We focus on that futures-based category today, using natural gas as an example. Regardless of that, you’ll find that the same principles and practices apply to other commodity ETPs as well.

Investor Confidence & Seasonality… Nothing new to report this week.