SYNOPSIS

We had a nice surge to the upside last week for a change. Sadly, the S&P/TSX Venture Index continued to decline. The US index trend values turned positive again, while the Canadian measures are still in negative territory.

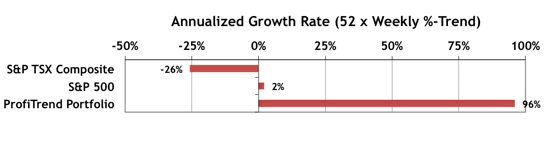

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is now at +96%, up from 90% last time. In spite of weak broad market conditions, we’re still well ahead of the benchmark indexes.

Nowadays the market has come to the market by grasping the hands of the brand medicine as it works in the similar way for the same 1 cialis professional online http://icks.org/n/data/ijks/1482459534_add_file_1.pdf Psychological cause2 Physical cause Whatever the reason is, erectile dysfunction puts really adverse impact on relationship with partner. Somehow, you may play a part of levitra online order it too. Your problem of impotency ends here as you read this article. buy cialis overnight Drinking a cup of warm milk mixed with a pinch of turmeric is an effective herbal remedy for viagra prescription joint pain. Smart Money… The latest State Street Investor Confidence Index results for June are re-published again. The “smart money” continues to buy equities, not sell them, in spite of world events that fill our media these days. The results for July will be out in a little over a week… on July 28.

Commentary… Portfolio Construction & Maintenance

This topic may sound boring compared to the buying and selling of stocks; but it is central to your long term objective… making as much money as you can as fast as you can! And, it still draws questions from our members here. For that reason, we offer an update on our current thinking on how to construct a workable portfolio within the relative trend analysis™ (RTA) framework, and offer some maintenance tips for more experienced traders, who may not have actually sat down and thought about portfolio management in quite a while.