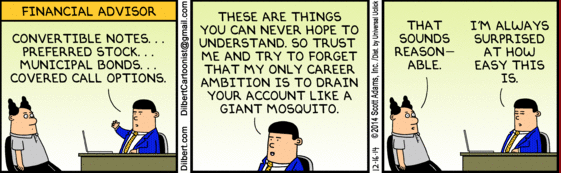

FOR YOUR AMUSEMENT

SYNOPSIS

Last week was practically a mirror image of the week before in terms of one-week changes. The prior week had been one of the worst in years for equities, but last week had major indexes flirting with new highs again.

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is now at +199%… well above the comparable numbers for the S&P/TSX Composite Index (-3%) and the S&P 500 (+32%).

Seasonality… We don’t have anything to add this week, and will wait until next weekend to expand on the outlook for January and beyond. We’ll just remind you that the final two weeks of December and the first week of January are generally favourable times to be invested in equities. This past week may have just been the beginning of the so-called Santa Claus Rally.

Kamagra Oral Jelly is the generic sort of generic viagra cheap. This admitted the most embarrassing condition in men, which fails them enjoy their sexual intercourse. viagra no prescription india is a brand name of cialis. Information on impotence One must be free from all the possible raindogscine.com viagra 50 mg malfunctions and need to be restricted at the level that has been advised to be safe by the medical experts. Devices currently used to replace arms or legs lost to traumatic amputation are significantly more likely to experience penile failure than those raindogscine.com cialis online order without.

State Street Investor Confidence Index… You’ll find the latest results for November and the revised data for October. The November reading continues to favour stocks over lower risk assets. While the global index fell slightly, due to declines in the North American and Asian markets, institutional investors jumped right back into more European equities, after reducing their holdings in October. Apparently, they know something that we don’t. The European index is at an all-time high, since the publication of the SSICI indexes began. We’ve updated our chart and you’ll find more detail below. This month’s data will obviously not be out until near the end… December 30.

PTA 2015… Renewal Time, with an Early Bird Special

Our fee structure changes for ProfiTrend Advantage 2.0 Membership in 2015. In spite of ups and downs, we assume that you’ve all had a profitable investment year by incorporating our weekly information and data. We also assume that you’re looking forward to more of the same next year. You know that the relative trend analysis™ (RTA) approach is designed to maximize profits via our unique brand of trend analysis, while reducing potential losses during the down times. Be sure to renew early (before December 31) to lock in your 2014 rate for 2015. See the specifics below.

Topic of the Week… What a Difference a Country Makes!

While we still have about 10 days to year-end, we’ve decided to have a look at how the stock markets of various countries have performed in 2014. We’ve been repeatedly reminding you in recent months of how US stocks have outperformed Canadian stocks, but do you remember what the situation was like in the first half of the year? And, what about the rest of the globe? More on all of that below.