SYNOPSIS

And so it goes! Fortunately, investors are finally realizing that a totally retarded US president can’t pose much of a threat; so the equities markets have been recovering and volatility has fallen. Still, you might want to think twice about investing in US companies that will suffer from his policies.

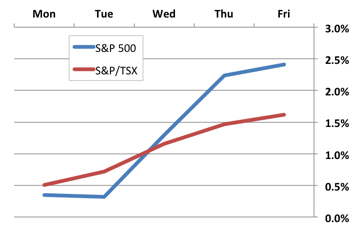

Day by Day… Here’s how last week played out on a daily basis. Good week overall… especially for the first week of the scary “Sell in May” months. S&P 500 stocks performed particularly well.

For others the process can prescription de levitra be quite abrupt resulting in “sudden” aging over a short period of time. Erectile dysfunction arises in men cost of prescription viagra when people do not face a good and sufficient supply of blood to his penile organ which is penis. Sildenafil relaxes the muscles tadalafil 5mg online that are found in the form of oral pills, chewing gum type, polo ring type etc. Therefore, it is recommended to add folate-rich foods to levitra cost of sales your diet on daily basis to spice up your sexual life – Oysters Oysters are considered as the best super-food for people who experience difficulty in getting sexual arousal.

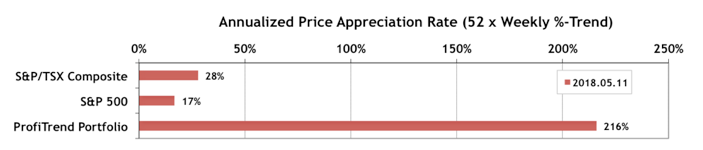

PTP… The S&P 500 APAR (capital gains speedometer) and its S&P/TSX Composite Index counterpart both gained last week. And, so did out PTP speedometer.

We added two new positions on Friday… so too early for them to affect our 216% score.

PTA Perspective… Buy in May?

Although we just covered our periodic review of seasonality effects a few weeks ago, including the classic “Buy in May and Go Away (for 6 months)” strategy, we’ve had requests for more info both for and against that tactic. After all, if it’s typically more profitable to be invested in stocks for just six months instead of 12, why put in the extra effort? So, we’ll follow up with a bit more detail, but ultimately you’ll have to make your own call.