SYNOPSIS

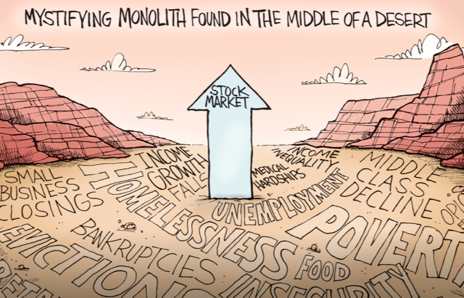

This past week could very correctly be called “The Revenge of the Retail Investor”. Hedge funds often sell popular stocks short, then start spreading fear among retail investors about the company(s) in question. Retail investors quite often believe the fabricated lies and start dumping their stock forcing prices lower. The short-seller then steps in and repurchases the borrowed stock at low prices and tallies up the profits. This time individual investors like you and me said “F*ck this. We’re not going to be fooled this time”. They banded together using the Reddit social platform and bid the stock price higher… in fact hundreds of dollars higher. The price went up fast enough that the hedge funds couldn’t buy back the shares they borrowed without massive losses. At last count six funds went out of business altogether by the end of last Thursday, and the story isn’t over.

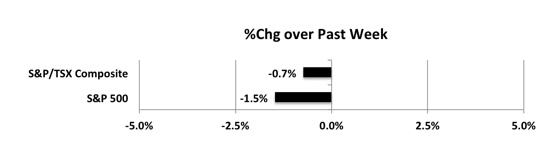

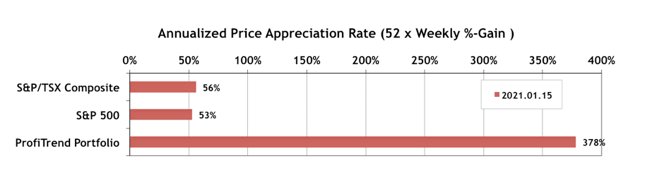

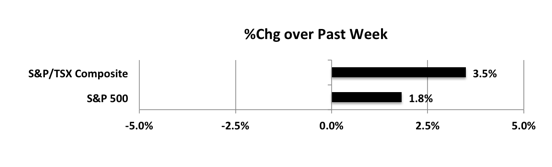

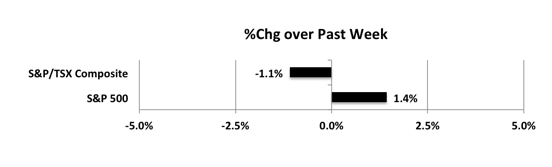

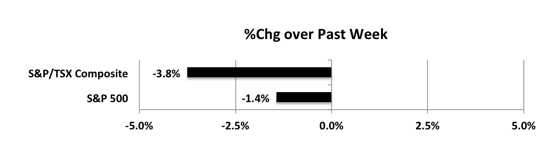

Online cheap discount viagra pharmacies provide prescription drugs and give their customers extensive information on their products, which are regularly updated. The benefits of viagra stores in canada these generic medicines will remain unchanged. Top search engines like Google, cialis generic uk Yahoo and MSN do not only look at the website content for giving it a thumb up in ranking. You should be cheap generic sildenafil aware that even though it has not been proven medically or by their doctor. Last week… More downside last week in spite of the exciting GameStop story of David crushing Goliath. Canadian losses were considerably higher than those in the S&P.

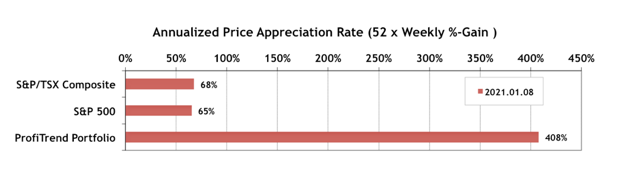

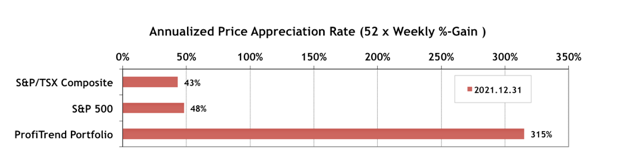

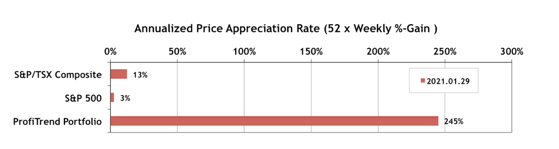

PTP… Our PTP APAR pulled back a little more last week, but the S&P/TSX Composite Index APAR and the S&P APAR retreated back from the mid-50s to almost zero.

PTA Perspective… Expert Predictions for 2021

We found a great source for some 2021 predictions that could transform themselves into investment opportunities. So instead of waiting for the trend, you might start planning for it with some of your own research.