SYNOPSIS

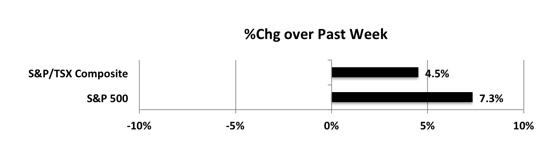

Anyone getting bloated from too many all time highs in the major indexes? We’re not, especially since the broader market is participating. This isn’t just the mega-caps hoisting the indexes up as often happens.

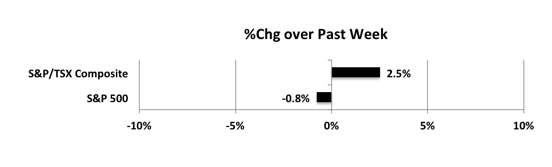

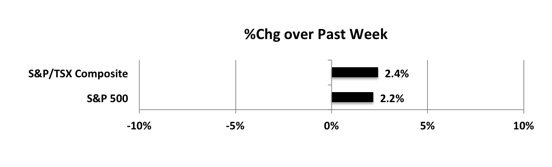

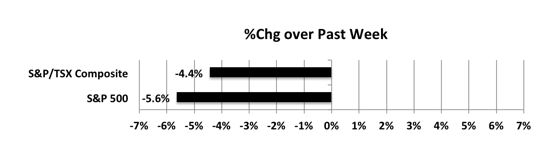

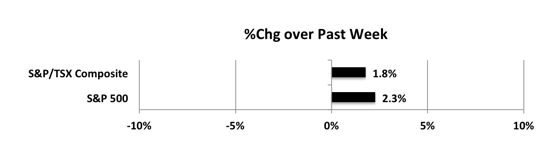

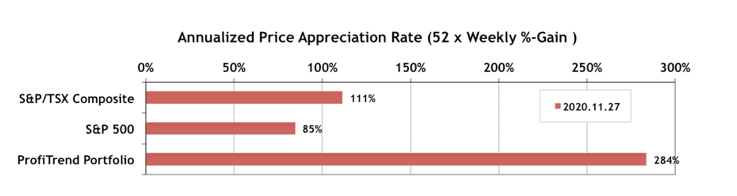

Last week… Quite acceptable gains on both sides of the border this week.

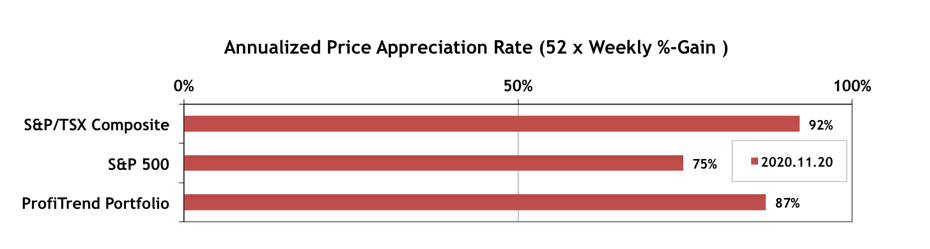

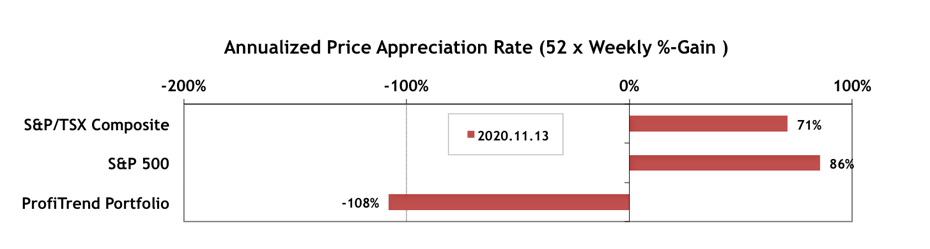

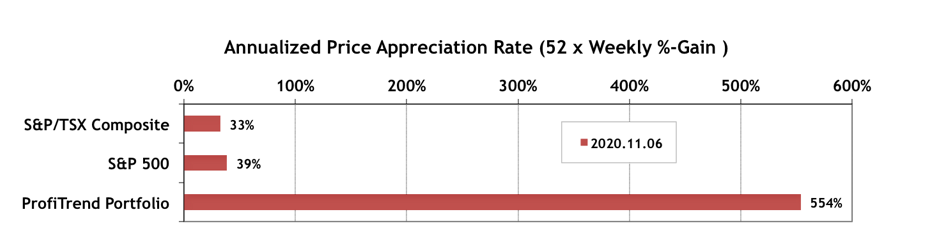

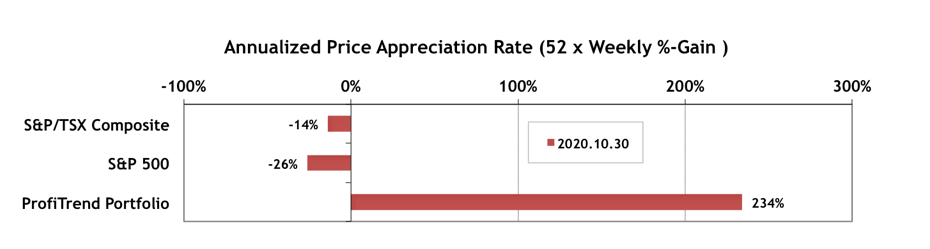

PTP… Portfolio repair is really a topic we should cover in more detail sometime, but you’ve been able to see from our PTP dip into the negative side in one recent week, that portfolio repair (especially from an almost empty one) takes a little time. We pick a few of the best trending stocks with a bit of extra scrutiny; but they don’t all shoot out of the gate at 0-100kph in 10 seconds. They sometimes need a little time to resume their momentum, if there has been a pause due to overall market conditions.

Anyway, we’re on our way again and also happy to see our benchmarks at levels we haven’t see in quite a while too.

PTA Perspective… What’s Up with the Smart Money?

We used to report the State Street Investor Confidence Index every month just after it was released. It’s a measure of money moved by large institutional investors between stocks (riskier) and bonds (super-safe). We don’t publish it monthly anymore (for reasons we’ll get into), but it’s worth having a look now and then. The “smart money” still appears pretty dumb in 2020. More in this edition of TrendWatch Weekly.