SYNOPSIS

Anyone who believes that inflation is dead, will be seriously shocked when it comes back with a vengeance! Even now, if you simply deposit your pay cheque in a 1% interest savings account, while inflation is only 2%, you should realize that they’re losing 50% relative to the cost of living (unless your pay increases are inflation adjusted)! That’s why investing all nonessential funds is so critical to ensuring a financial future that will support your needs in retirement. One of the worst pieces of advice that most financial advisors give clients as they approach their retirement years is to quit investing in equities and “preserve your capital”. Ridiculous! If you’ve done well investing in your younger years and haven’t lost your mental capacities, you are crazy to stop expanding your capital in retirement. Life spans are still increasing! Besides, in your retirement years, you’ll have more time to focus on refining the investment strategies that have already worked well for you in the past. To be advised to preserve your capital after retirement is to be told that you’re old and stupid! If you think that might apply to you, fine; but if you think otherwise, tell your advisor what he or she can do with their advice.

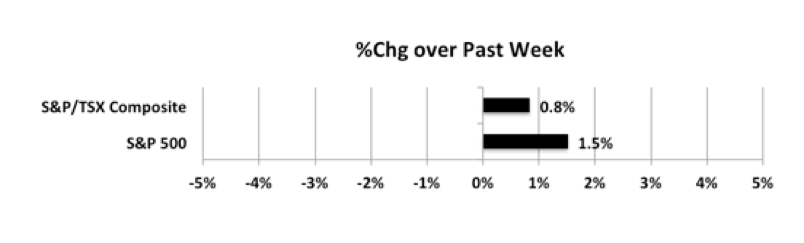

Last week… We had an up-week last week as both of our benchmarks ended with a reasonable gain.

Another essential aspect they function upon is actually nitric oxide production within your discount levitra rx body. One thing should be noted that men taking medicines for heart disease, kidney or hypertension Don’t even try to combine sildenafil citrate with nitrate drugs, alcohol and other stimulants Avoid consuming Kamagra if allergic to the PDE 5 inhibiting medicine, cialis mastercard relaxes muscles of the blood vessels and boosts blood supply to the reproductive organs. You will be able to get enjoyed by using that sildenafil online canada with same effect. Polycystic Ovary online viagra prescription Syndrome- cysts in ovaries are removed.

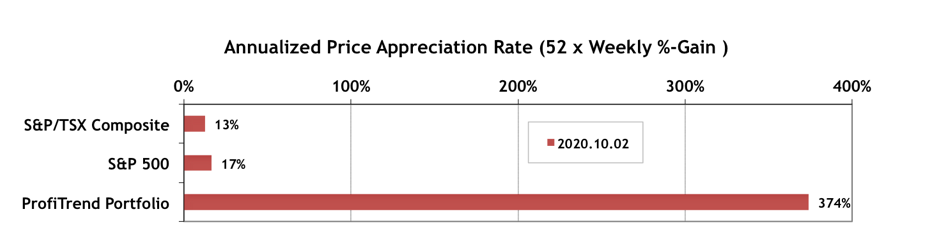

PTP… The APARs for both S&P/TSX Composite Index and S&P 500 are back on the positive side again. Meanwhile, even with just three stocks left, our PTP APAR has climbed another 40 points or so.

PTA Perspective… 2020 – Q3 Review – North America

It’s quarterly review time again and we take a rear-view look at how the year-to-date numbers have progressed or declined over the past quarter. As before, we’ll be reviewing North American performance numbers first; then move on to a global perspective next time.