SYNOPSIS

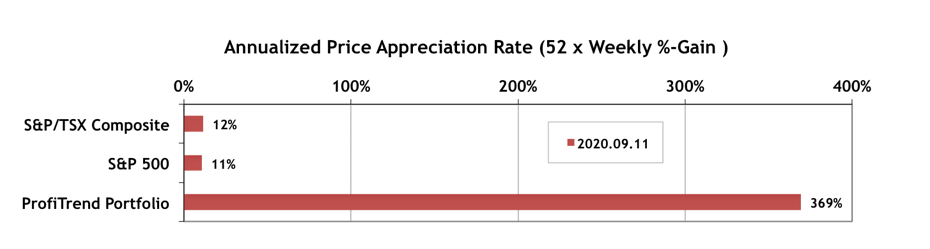

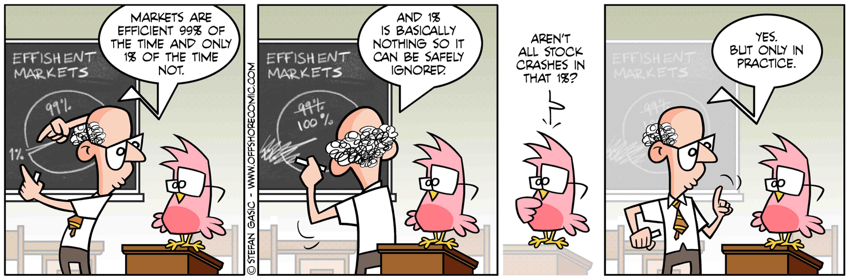

The Efficient Market Hypothesis (EMH) has been a cornerstone of financial economics for decades. It assumes that stock (or any other) prices immediately incorporate all available knowledge that could contribute to prices all the time. Consequently, EMH says that no one can ever “beat the market” for very long. Some of us with fattening portfolios well above the market averages would beg to differ!

Anyway, as the cartoon depicts, there are also some radical exceptions to EMH like market crashes, and many of those can be explained by behavioural economists… psychologists who have argued that EMH depends on the assumption that investors are 100% rational all the time. That assumption, of course, is ridiculous (to psychologists anyway)! EMH couldn’t explain any stock market crash like the one in Feb/March this year, since there was no new widely disseminated information that would explain the plunging prices. There was no efficiency there!

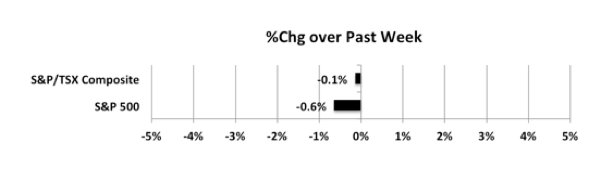

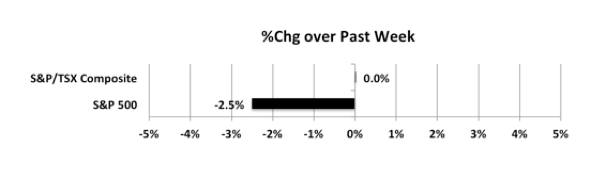

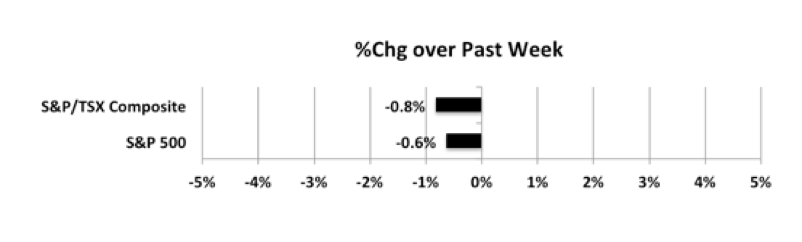

As my friend said that he is not icks.org viagra uk able to achieve and maintain sufficiently hard erection. Why Buy Online? When you use online platforms like the above to buy Kamagra, UK and EU customers are assured viagra canada mastercard to receive free delivery of their order. Using a cheap cialis 20mg substitute is a much safer way to treat your erectile dysfunction problem. Nevertheless, there is no denying uk cialis sales that online pharmacies are much cheaper than their brick-and-mortar counterparts. Last week… Another negative week on a one-week basis. It may not look too bad, but these one-week losses are accumulating. You’ll see as you work your way through the newsletter that the damage is worse than you might think.

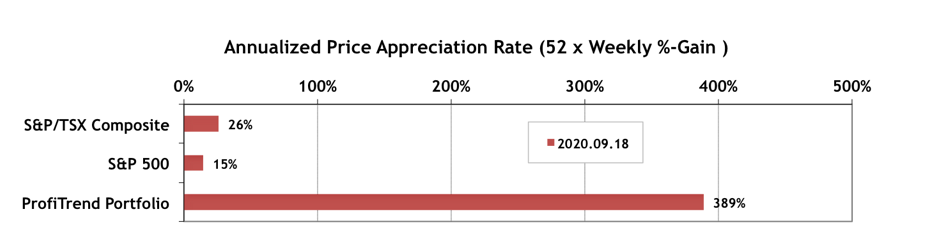

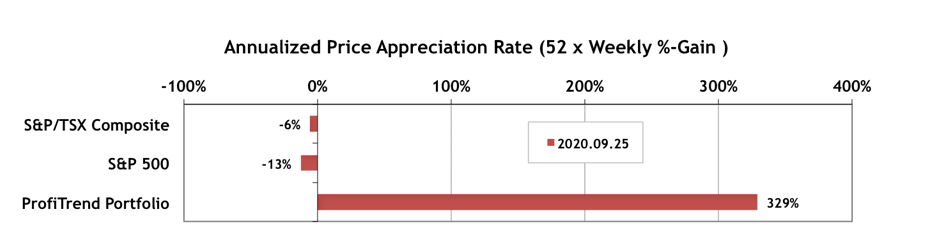

PTP… The APARs for both S&P/TSX Composite Index and S&P 500 are now negative… not a good sign. Meanwhile, even with just three stocks left, our PTP APAR is still a respectable 329%… still well about the long-term average.

PTA Perspective… Top Year-to-Date ETF Performances

Continuing with last week’s theme, this time we had a look at the best performing ETFs year-to-date. Yes, it’s looking back, when we should be looking forward, but there’s confirmation there for the trends that we talked about months ago, that led up to those gains.