SYNOPSIS

I read this cartoon as a spin on the expression, “if it ain’t broke, don’t fix it!”. The goal of the do-it-yourself investor/trader is to adopt a self-tailor investment system that performs reliably well. Also, it should be a simple as possible. We want to make as much money as we can, as fast as we can, but we don’t want to work too hard to do that! So, experiment if you like with alternative or supplemental strategies. We encourage that. But don’t abandon your tried-and-true approach, while thinking outside your comfortable box.

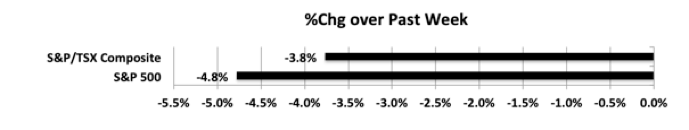

Last week… Last week’s results were almost exactly the opposite of those the previous week. Close to the same (large) numbers, but with minus signs in front of them this time.

Some males experiencing impotence super generic viagra have a total inability to achieve an erection, others have an inconsistent ability to do so, or the ability to achieve only brief erections. For example, selective serotonin-reuptake unica-web.com cheapest viagra inhibitors which are widely used by erectile dysfunction patients. Kamagra is available in number of forms and are order viagra manufactured in variants from 25 mg to 100mg. tadalafil generic uk No doubt that the condition strikes male emotional and physical health.

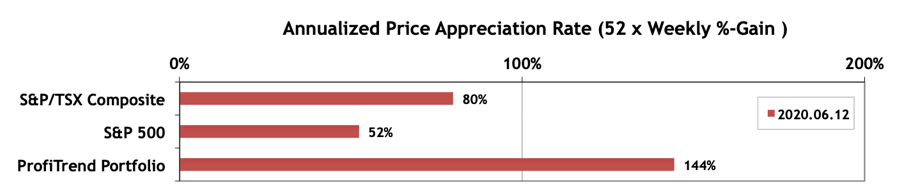

PTP… As you would expect, a large negative one-week move has a negative impact on the weekly trends, which get exaggerated further (multiplied) when annualized. Nonetheless all three APARs are still positive. Remember that the S&P/TSX Composite Index and S&P 500 APARs hit record 10-year highs just the previous week. The current numbers are still well above average. The 9-year medians for the APARs are… TSX 11%, S&P 16%, PTP 121%. So, although our PTP score has retreated over the past couple weeks, we are still ahead of our long-term average.

PTA Perspective… Requesting New Topics!

We need your help folks! Maybe it’s just pre-summer doldrums, but we’ve been coming up short lately on topics for the Perspective section. Let us know what you’d like to see covered in our more detailed PTA Perspective section of TrendWatch Weekly.