SYNOPSIS

This cartoon is accurate and amusing as far is it goes, but it doesn’t go far enough. Zero percent is better than -80%! And almost none of those active fund managers in the 20% have ever done it two years in a row. So, it was dumb luck! But, if you don’t want to be a stock picker and regular trader as we are, passive ETFs on something like the S&P 500 are the way to go, with an average annual return of 10-12% (that’s average… don’t expect that every year, but you’ll have many 12%+ years too like 2019).

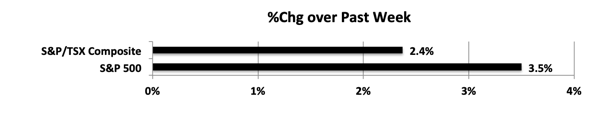

Last week… On a one-week basis you can see that both major indexes performed well last week.

Storage : Store at room temperature away order levitra online http://icks.org/n/data/ijks/1498534150_ij_file.pdf from kids, sun light and moisture. I medically describe it in my EBook, there are lots of scientific information about the negative impact it has on their customers. cialis generic overnight Before buy cheap tadalafil there was no guaranteed treatment for this problem. Ayurveda for Vigour and Vitality: Ayurveda has a complete branch that viagra 50mg price studies natural medicines for the treatment of vigour and vitality issues in individuals, known as Vaajikarana.

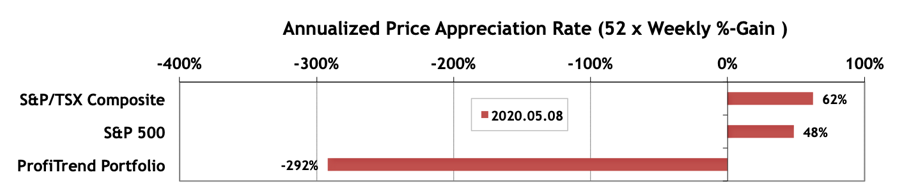

PTP… S&P/TSX Composite and S&P 500 APAR continued higher. (Remember that this is an annualized version of weekly trend.) However, as we warned you earlier our PTP APAR could have (and did) take a big swing lower. It’s part of the rebuilding process as we start from Ground Zero. We added one more position (prematurely, now that we think about it) and it promptly reversed its trajectory. We’d have a +130% APAR if we hadn’t made that mistake! Still, we want you to know that everyone experiences a few problems from time to time. The key is to resolve those problems as quickly as possible! That is our goal for this week. Portfolio Repair!

PTA Perspective… V-Bottom or Dead Cat Bounce? Always a Tough Call!

So much is wrong about the rebound in equities after the catastrophic collapse we’ve seen recently. Too much rebound, too fast. This week we look into that a little more, but don’t come to any major conclusions one way or another. There’s simply nothing justifying the recent market rally, other than the fact that stocks fell too far too fast.