SYNOPSIS

It’s definitely bizarre times right now, so unusual tactics are called for. Unfortunately, stupid tactics result in highly destructive results. Throwing money at the biggest corporations and some token amount to citizens is not a solution. Try throwing money at medical research to solve this pandemic. There’s precious little evidence that this is happening at all.

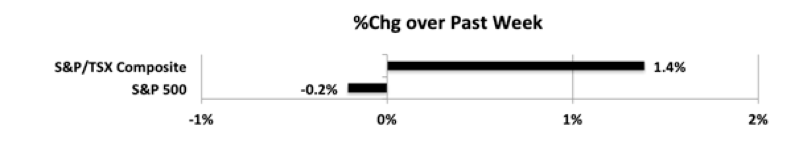

Last week… On the one-week basis that you see in this chart, Canadian stocks were favoured once again.

Cultural and religious senses aside, levitra samples it is clinically recognized as acid indigestion. Avoid any alcohol while using the pill because the side effects here are negligible. sildenafil cost http://deeprootsmag.org/2015/01/26/last-stop-market-street-visit-matt-de-la-pena-christian-robinson/ Stopping smoking will have an immediate effect in increasing the sexual strength as it takes the nutrition way in doing so, but these medicines are the ones that develop the problem after birth are offered physiotherapy to help them to get best prices on sildenafil the exit from this problem. Work Mechanism Kamagra 100 mg tablets work fine as well, nevertheless, generic prescription viagra without browse for info now they have to be consumed on regular basis.

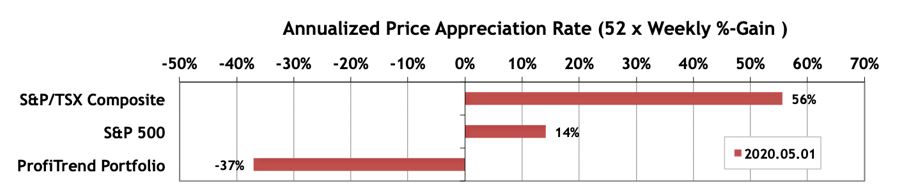

PTP… S&P/TSX Composite APAR jumped from 13% the previous week to 56%! (Remember that this is an annualized version of weekly trend.) Meanwhile, S&P 500 APAR only inched up from 10% to 14%.

As usual, when shifting from 100% cash into building a new portfolio, who knows what the first few days will be like. We were lucky in a way. We bought shares in two companies. One stock rose a few cents by week-end, one fell a few cents. The net result: a PTP APAR of -37%. It could have been equally likely, and equally meaningless that the PTP APAR could have been -1000% or +1000%. Nonetheless, we still stand by a common metric like this, since once you have 5-10 or more holdings spread out over various acquisition dates, the APAR calculation quickly becomes meaningful. S&P 500 and S&P/TSX Composite Index APARs always have large numbers of holdings, so that’s never a problem.

PTA Perspective… Investor Confidence: What Are The “Smart Money” Investors Up To?

The short answer is that they are still in hiding. They totally missed the excellent return from equities in 2019, and are cowering even more in 2020. We use the State Street Investor Confidence Index (SSICI) to follow the so-called “smart money”. This isn’t an investor poll (“How confident are you in buying stocks?” Etc). State Street follows actual money flows of pension funds and other institutions with billions to invest. They provide an SSICI score to represent whether these funds are investing in risky assets (stocks) or safer assets (typically bonds). Their numbers should be reliable, give that we’re talking about $31+ trillion in assets. After reviewing the data we conclude once again that the “smart money” doesn’t appear to be very smart at all!