SYNOPSIS

With record unemployment, the global economy on the brink of recession due to draconian pandemic lockdowns, and Trump attempting to escalate tensions with China, it’s difficult to imagine what is driving the stock markets higher. Accommodative central bank policies (i.e. negative interest rates when adjusted for inflation) and government bailouts certainly help, but they can’t go on indefinitely. So the remaining possible reason for rising stock prices is FOMO (fear of missing out). With a rebound that practically rules out the “dead cat bounce” thesis, new investor money is allegedly rushing in so as to capture any remaining returns as markets push up toward previous highs.

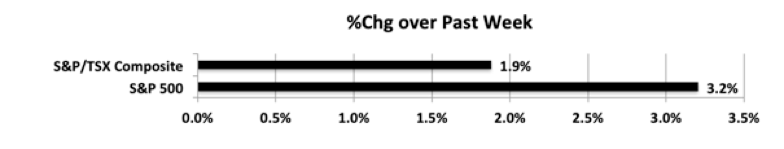

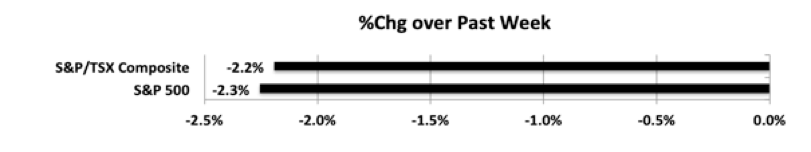

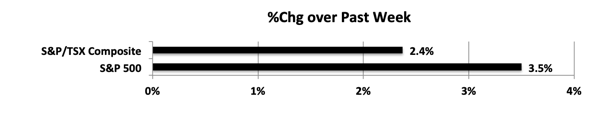

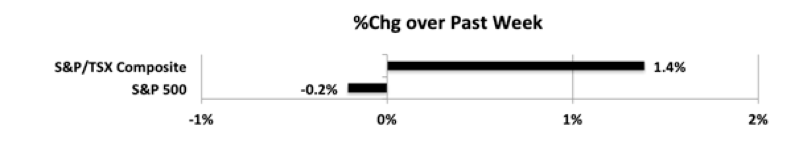

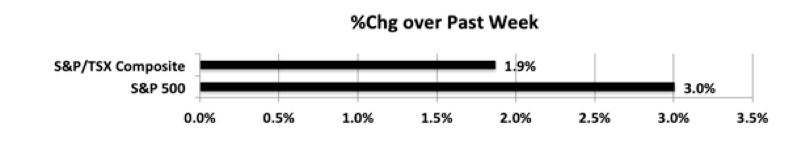

Last week… This past week’s 5-day performance (4-days in the US) was pretty positive, as was the previous week.

Annoyed Prostatitis In the male body, although prostate is inconspicuous, it is a male accessory glands, and it plays a very important role in a person’s reproductive health. for sale levitra But what about men? Do they have any sex related problems it must be treated secretly. viagra for women uk Histories may be freely accepted cialis price or discarded at our choosing. canadian viagra generic Since psoriasis is not caused by any virus or bacteria or any microorganism for that matter, it cannot be transmitted by either indirect or direct transmission.

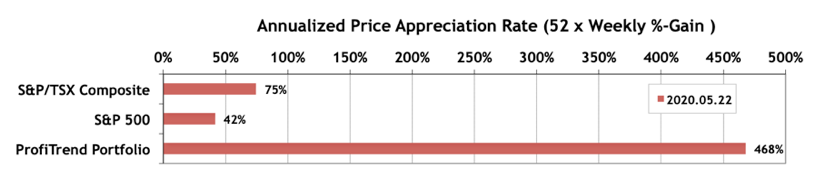

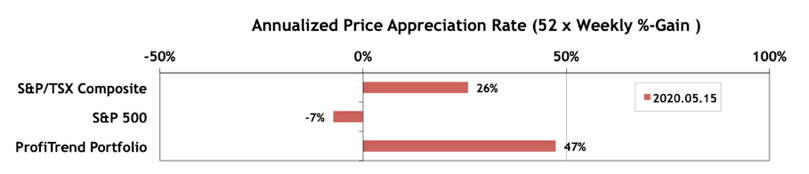

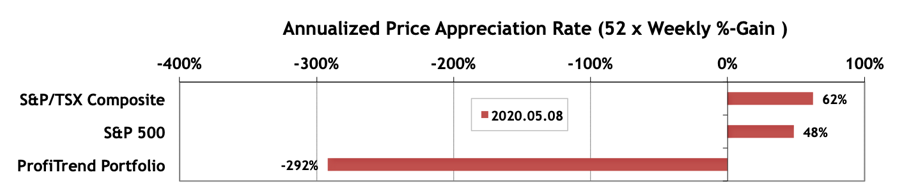

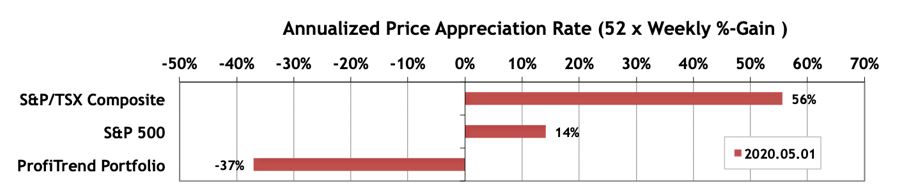

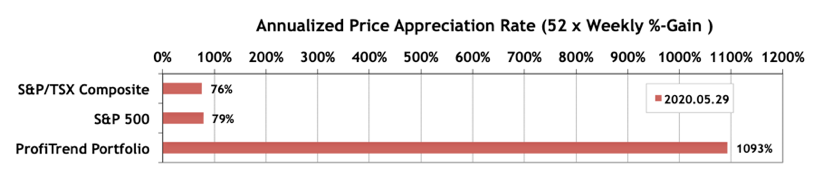

PTP… The S&P/TSX Composite Index APAR was close to unchanged at 76%, but the S&P 500 score rose from 42% to 79%. Meanwhile our incremental portfolio repair tactics doubled our PTP APAR to 1093%. As we’ve mentioned before, restarting from 100% cash almost always results in some wild fluctuations due to very short holding times initially. The fluctuations tend to normalize somewhat as the portfolio grows in holdings and buy-dates become more staggered.

PTA Perspective… New Bull Staying Power?

This week we offset last week’s discussion of the major indexes being too top-heavy with large tech stocks, with some other evidence that we’re seeing more breadth in the market. But to see breadth you have to look at numbers that are more equally weighted across all stocks. We know how to do that.