SYNOPSIS

Ah, yes, the myth that diversification is the path to investing success! That’s only true if you’re referring to the success of your financial advisor or money/wealth manager. Broad-based buy & hold diversification is a sure path to failure, relative to consistent rotation through the best-performing regions and sectors. You can call that sequential diversification, if it makes you feel any better!

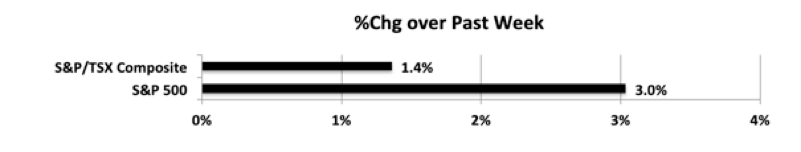

Last week… We expected a retreat after a phenomenally positive week in equities discussed in our last edition. But, as luck would have it, we had some follow-on to the upside into last week to keep the positive beat going.

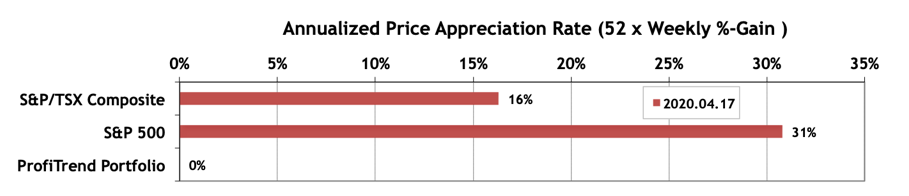

PTP… This chart didn’t change much from the one we showed you last week. We’re still 100% in cash, and will stay that way for a while. We’re not avoiding volatility (which we normally welcome). We’re avoiding too many layers of risk.

PTA Perspective… 2020 – Q1 Review – Global Perspective

After rolling out the Q1 2020 report card for North American stocks recently, it’s time to follow-up with a global perspective in this week’s edition of TrendWatch Weekly after a one-week postponement. We use two datasets to measure global equities performance: country ETFs and ADRs. Both are indirect ways to assess the worldwide situation, because Americans aren’t allowed to buy foreign stocks or ETFs on exchanges located outside the USA. Canadians have many more options, but we’ll keep it to the lowest common denominator. I think we all know that the results will be a poor Q1 2020 across the board, but we bring you all the details in this week’s edition.