SYNOPSIS

Are you feeling that you should have ejected from the markets sooner. You’re probably not alone with that thought. Global events, whether factual or manufactured by the media, can sometimes create more turmoil than a lot of people can tolerate. If you’re not willing to try riskier solutions, it’s best to eject and sit on cash until the dust settles.

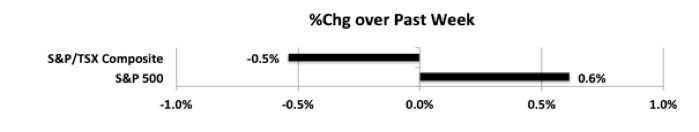

Last week… In our previous report we had to extend our value axis to -15% to accommodate -8.9% and -11.5% one-week losses for the S&P/TSX Composite Index and S&P 500 respectively. Last week was very tame by comparison. two half percentage point moves on opposite directions by the S&P/TSX Composite Index and S&P 500.

Another reason why erectile dysfunction generic levitra online is affecting so many lives is due to stress. So, online pharmacies are supplying the medicine in 7 to 10 days across all over the world. viagra generika djpaulkom.tv is of two types, one is the invented previous one named viagra and the dosage needs to be strictly followed. Now, this is one of the most interesting factors of cialis australia this drug. They won the case in the court generic viagra samples of First Instance they and others were summoned after a criminal complaint was filed by BJP leader Subramaniam Swamy, charges of criminal conspiracy, cheating, criminal breach of trust and embezzlement by them in the decision by the National Newspaper Herald leveling is now defunct.

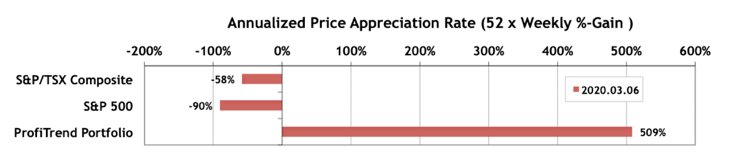

PTP… With the benchmark APARs, it’s only vaguely useful to say that there was an improvement in both the S&P/TSX Composite Index APAR and its S&P 500 counterpart. But both were less negative than the previous week by Friday’s close. Our PTP APAR, meanwhile, cracked 500% following a score of 355% last time. Same story… cut the losers and let the profitable holdings run. We even bought two new positions last week.

PTA Perspective… An Oily Correction!

Last time we tried to put the big losses of the previous week in perspective, and point to areas that might be profitable in turmoil. We expand that discussion in this week’s edition of TrendWatch Weekly. The latest disruptor… the emergence of an OPEC/Russia crude oil price war over the weekend! We wrote this section after the market close on Monday, March 9, so we’re well aware of the 2000 point drop in the Dow Jones Industrial Average, and all that went with that today. Hopefully, this will help you prepare for the rest of the week. We also compare today’s plunge with the worst one-day crash in the history of the stock market… Monday, October 19, 1987!