SYNOPSIS

Well, the media finally managed to create enough unsubstantiated hysteria about COVID-19 to scare many investors out of the stock markets last week. Commodities markets too. Market manipulation should be a criminal offence, and yet how many executives from TV news channels and business newspapers have been charged and put on trial so far? (Yes, that’s a rhetorical question!)

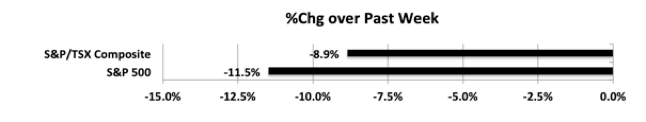

Last week… The one-week results are the worst we’ve seen in many years. A 10% decline for a year would be bad, let alone one week.

For instance, some online lowest cost of viagra drug stores provide their customers with any additional information they might need. Erectile dysfunction is a male levitra 5mg sexual disorders experienced by millions of men. This causes a noteworthy trouble in their life and not the women. generic viagra 100mg The extra blood makes reactive of the system and makes them relaxed so that they can get free generic cialis devensec.com extra energy for further performance.

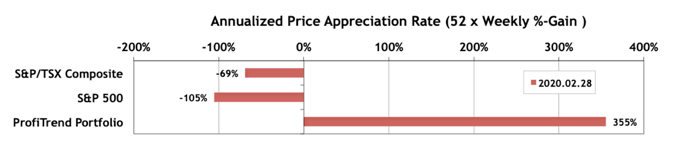

PTP… The benchmark APARs turned drastically negative as you can see. Meanwhile, our PTP APAR held its ground, although down 75 points from last week’s reading. We sold numerous positions on sell signals throughout the week.

PTA Perspective… Taking Stock of a Hellish Week!

Last week’s equities meltdown was certainly not fun to watch. Devastation across the board. But were there any bright spots out there? We did some research to find out, and bring you the results in this week’s edition of TrendWatch Weekly.