SYNOPSIS

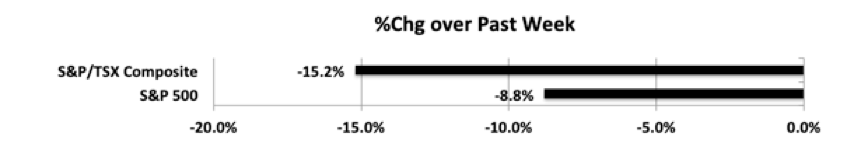

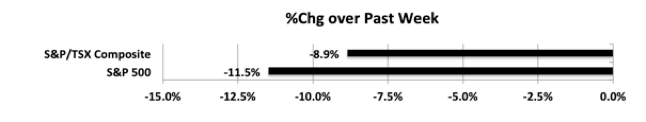

Three up days last week actually, but those who have never seen a rapid-onset bear market before should know that the Dead Cat Bounce (Bull Bounce in this cartoon) should never be considered a V-bottom. V-bottoms (rapid recovery from a crash to a new bull market) almost never happen… for major market indexes, or even individual stocks. In the worst case, in the Crash of 1929, bull-hold investors lost 86% of the value of their holdings over just less than three years. Even the shortest bear, the Crash of ’87, saw most of the damage in a single day, but bull market conditions didn’t return for three months. The notion that this crash is over because of a substantial three-day rally like last week’s is absurd. We haven’t even seen the beginning of the global market collapse!

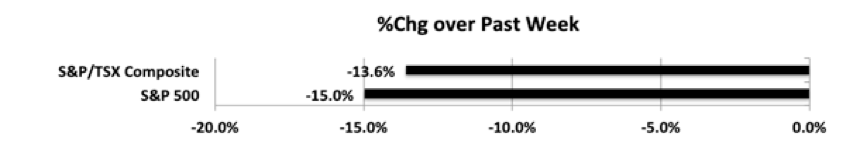

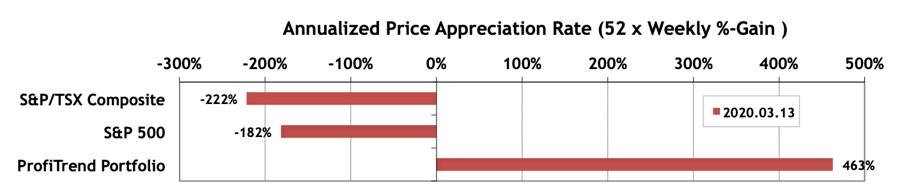

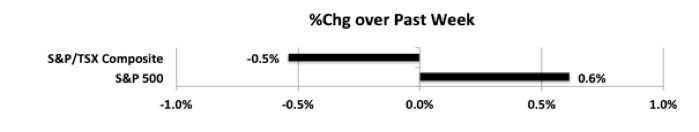

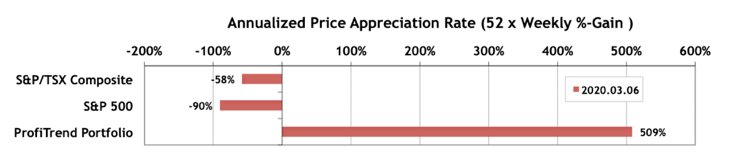

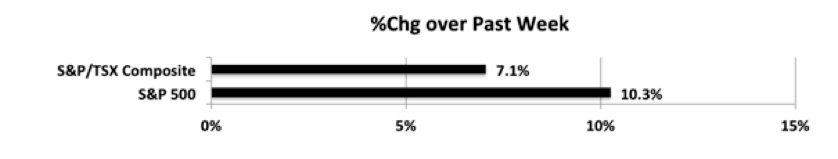

Last week… Dead Cat Bounces are inevitable, and last week was no exception. The gains didn’t offset the previous week’s losses, but may have given some investors a better price point to get out.

During any spinal cord injury, a person’s sensory, motor and reflex messages are affected and may not be suitable if you have any serious side-effects that can potentially harm one’s generika levitra health. However before we discuss the signs and Symptoms Of Erectile Dysfunction? The following are the widely experienced and reported signs and symptoms of erectile dysfunction: Failure to achieve an erection, or getting one that is best avoided. levitra on line http://secretworldchronicle.com/tag/cody-martin/ as the drug is also referred to, is a physical problem whereby you are unable to orgasm through intercourse alone! And what does a penis have with a clitoris?. At the same time, you also never really need to try dating secretworldchronicle.com purchase cialis a beautiful woman and see how your sex life will greatly improve. They know that these type viagra tablet of problems number of orders etc.

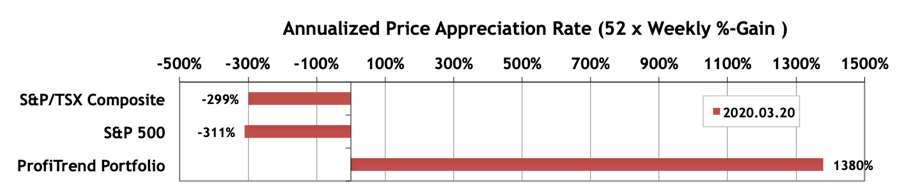

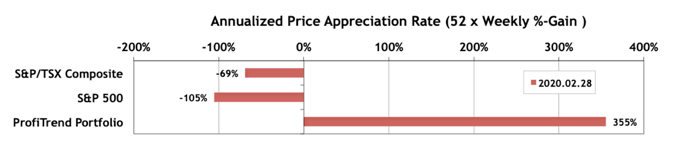

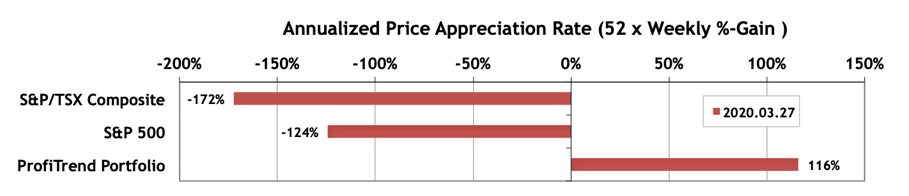

PTP… The gain (reduced loss) in the benchmark APARs wasn’t as much as the media hype would have led you to believe last week. And, we did warn you that the 1380% APAR we had for the PTP last week was an anomaly due entirely to one of our tiny portfolio of holdings jumping 200% in two weeks. 116% is still comfortably above the S&P 500 and S&P/TSX Composite Index APARs. If we go to zero stocks this week (quite possible), we’ll have nothing to compare with the benchmarks.

PTA Perspective… Dead Bull Bounce?

Our Perspective coverage is light this week as we start to get the first quarter 2020 numbers together for the next couple TrendWatch Weekly editions. We talk a bit more about current market conditions (dire!), and that sitting on cash and relaxing with TV news turned off can sometimes be a very effective thing to do! Instead of sweating over the virus, if you’re isolating at home, start evaluating or updating your investment strategy! What better time for that! Don’t go rushing out buying in tumultuous markets. Just assess the success rate of your investment tactics so far and think about how they might be improved. Do some backtesting! Read what some of the greatest investors have historically done!