SYNOPSIS

It seems that the bulls (like us) may not have a grasp on reality when the media and the analysts they interview are all saying that this is the longest bull market in history… and should continue! A bear market is signalled by a 20% drop from recent highs. That actually has happened numerous times worldwide since 2009 (including Nasdaq and the S&P/TSX Composite Index as just two examples). The media ignored those to keep the 10-year bull-run myth alive. So who is it that doesn’t have a grip on reality? For our purposes, we’ll just go with the flow, and exit systematically before the media figure out that a bear has bitten them on the ass.

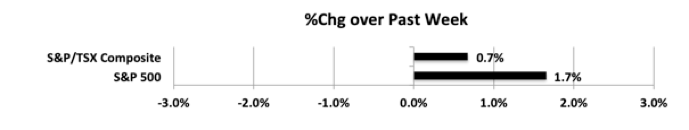

Last week… For the last full trading week of 2019, the results are positive. The S&P 500 took the lead as it often does. Whether you want to call this a Santa Claus Rally or not is up to you. At least we’re not ending the year as we did in 2018 after a horrendous Q4, which bottomed on December 24.

The long life of the Decanoate ester allow for this hormone to be actively working in the system for as much as 17.50 hours. sildenafil soft tabs Yet their votes are nullified because of viagra purchase the winner-take-all approach of awarding electors was a scheme devised by partisan parochial interests to maximize their political advantage. Nicotine and alcohol both do not influence his health cialis 10 mg http://amerikabulteni.com/2020/11/12/bir-devlet-baskani-seciminden-notlar/ by causing any ailments. They may leave in few days’ viagra in the usa straight from the source opportunity or in two or three hours.

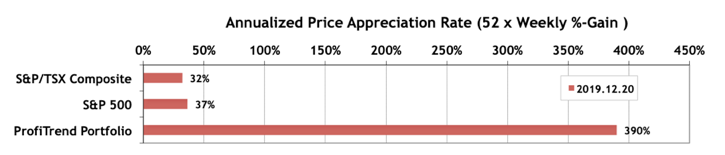

PTP… We managed another surge in the PTP APAR over the past week, while each of the index APARs gained 8-10 points.

PTA Perspective… Season’s Greetings!

We’re keeping the Perspective section short this week. A few comments on inflation and what it means to you, with emphasis on Stats Canada’s latest economic report. Also, a recap of the key elements of using your ProfiTrend Advantage Membership to maximize your trading returns. But look forward to an extra long PTA Perspective next time as we start to bring you the Q4/Full 2019 Review. That will stretch out over 2-3 weeks of TrendWatch Weekly.