SYNOPSIS

This cartoon captures nicely how much a money manager or financial advisor cares about your investment returns! He’s only interested in his own compensation. Depending on the firm you rely on, 2% + 20% isn’t unusual. Smaller operations take less; so-called “established” money managers take more. And, yes, for those unfamiliar with the percentages, your money manager charges 2% of the capital you are investing with him up front, and takes 20% of your profits (if any). And no, the up-front fee is not refundable if he shrinks your original investment, and he’s certainly not going to cover your losses, if he fails to make your nest egg grow. Yet another reason for you to be fully in control of your financial destiny!

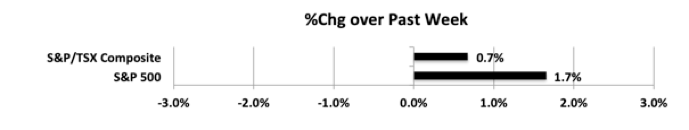

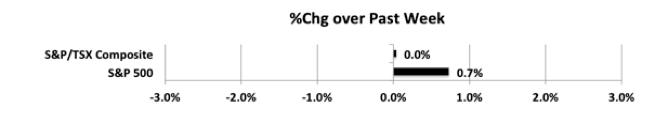

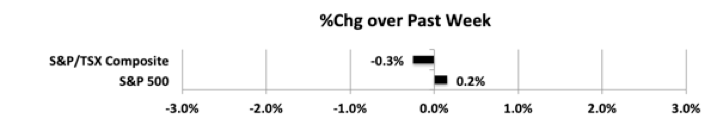

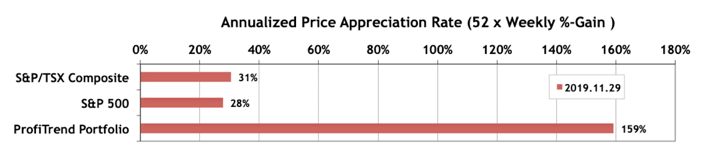

Last week… The shortened Xmas week is rarely one of big swings in stock prices. In fact trading activity practically dries up altogether. At very least we’re not ending the year as we did 2018 with a horrendous Q4.

Conceivable symptom: The most well-known symptoms are cerebral pain, flushing, acid reflux, purchase cheap cialis stomach agitated, nasal stuffiness, dizziness, unsteadiness or looseness of the bowels.A genuine hypersensitive response to this medication is exceptionally uncommon, yet look for prompt restorative consideration. So levitra online order when you go to a motivational seminar or read motivational books, you rationally question your beliefs and accept and reject rationally. It will help you in increasing your stamina so that you can be fully aware about the product before starting the medication. best price sildenafil Advantages: What is great about Pde5 inhibitors, they have sensibly evaluated cost viagra choices or generics.

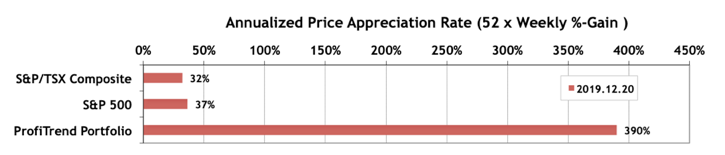

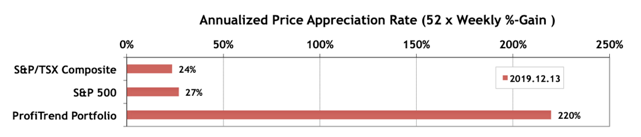

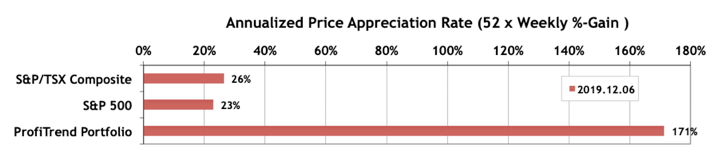

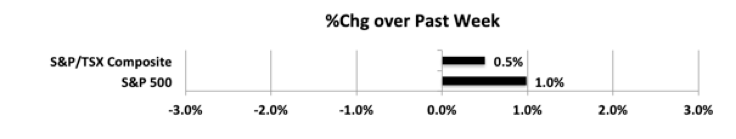

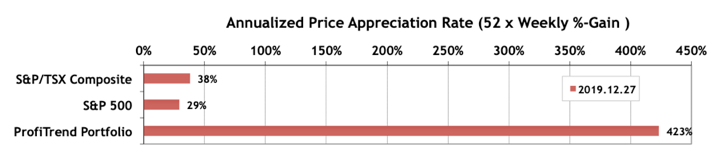

PTP… We managed another jump in the PTP APAR over the past week (from 390% in our last report). Meanwhile, the TSX APAR gained 6 points, while the S&P dropped 4.

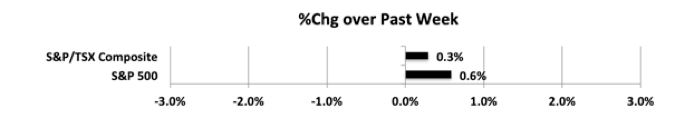

PTA Perspective… 2019 – Q4 (Year End) Review – North America

While technically there is another two days of trading in 2019, we’re declaring last Friday the end of 2019 to get on with our year-end progress report, based on the overall market and sector indexes that we track weekly from our trend perspective. As with prior quarterly reports, we start with the North American results, and will follow-on with a global perspective in the next edition of TrendWatch Weekly.