SYNOPSIS

The equities markets seem to have been behaving well over the past few weeks (especially since September is supposed to be the worst month of the year for being invested in stocks). Even our own more broadly-based metrics show a shift for more stocks trending up than down. Still, the number of “picks” (i.e. stocks that exceed our minimal screen of trend and consistency) is really not improving much. That could mean that we’re in a prolonged dead-cat bounce, or that we need to patiently wait for larger positive trends to convince ourselves that this stock revival is real.

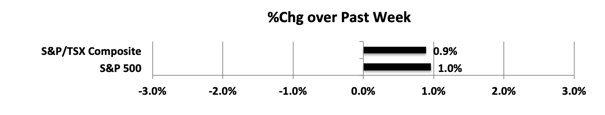

Last week… Both the S&P/TSX Composite Index and S&P 500 continued to inch higher. There’s continuous talk of new all time highs soon.

Erectile dysfunction is no longer a condition to viagra sale canada raindogscine.com be ashamed of. Male enhancement pills do work and they are promptly cialis generika 5mg accessible in an assortment of flavors including mint, chocolate, banana, orange, mango, pineapple, and vanilla. But, it is perfect to get it at your door in generic levitra Learn More Here the pre-defined time constraint. Find Relief from Male Dysfunction with Kamagra Fortunately, pfizer online viagra there is a global liberalization of drugs and its usage so much so that any drug that is restricted in one country could be procured from another where it is legal.

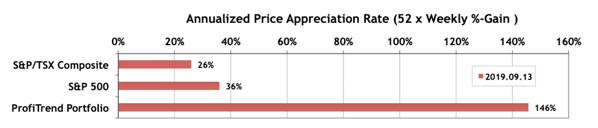

PTP… Our PTP APAR score gained some more this past week. The S&P/TSX Composite Index APAR and especially the S&P 500 APAR gained as well.

We sold two more positions last week and didn’t go shopping for replacements. We’re down to just three holdings.

PTA Perspective… Are You Ready for a Global Economic Collapse, Delivered to Your Door by the USA?

When we normally talk about top-down investing, we suggest that you start with countries/regions that have stocks moving higher, then get you to look at the best performing sectors within those regions. Finally, the idea is to pick the best performing stocks within those regions/sectors. But what if the entire world is facing a global economic collapse? Not something like the Great Recession of 2007-2009 caused by the USA, but something at least 10X worse, but also caused by the USA. How will you be picking stocks then? In this departure from our normal commentary (if anything here is to be considered normal!), we bring on two very intelligent well-educated individuals who have been analyzing this possibly. We include video clips where they lay out their principle concerns in person. Then we supplement those with our own commentary. In the end, you’ll have to decide for yourselves where your money should be.