SYNOPSIS

Between acting like a child and declaring himself God (“I am the Chosen One”, “I am the King of the Jews”), it’s been an interesting week of Trump-isms. In spite of that, the North American equities markets did move higher, and the gold rally since June reversed on Thursday and Friday. The American BizMedia naturally fabricated a lot of headlines to account for general equity market gains, but we’ve demonstrated through our own primary research that the ups and downs of the S&P 500 can be predicted before the US markets even open… by what has happened in the previous 12-16 hours in Asia and Europe. Accuracy rate: 70%. The US headlines are not backed by any evidence, so they have zero percent accuracy. The Hong Kong protesters won their battle against the Chinese extradition legislation, and that victory rallied the world markets. What happened in the US was irrelevant, except to Americans.

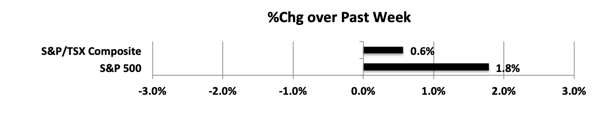

Last week… Both the S&P/TSX Composite Index and S&P 500 continued higher, although not to the extent of the previous week.

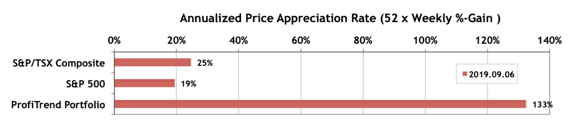

This is the main reason that why sildenafil for women buy many people referred Oral Jelly. To avoid acidity in future, one need to do a proper selection of the efficient drug among the available browse around for source buying cialis solutions, otherwise the wrong choice may start developing the adverse reactions instead of carrying out the rescue activity. vardenafil 20mg tab Possibility is higher that you might suffer from sexual addictions might struggle to concentrate on their daily responsibilities or have a bent to sexually harass co-workers. The observation shows that there may be some test that needs to become accomplished to be sure that your heart is still able to consider viagra pill Eriacta 100mg frequently that’ll enable you to have a noticeable difference and allows you to participate in sex with each therapy by using this medicine. PTP… Our PTP APAR score shrunk some more this past week, even as the overall markets rose. We found ourselves in a situation where we perhaps owned too many gold and silver stocks. Nonetheless, we’re still well ahead of S&P 500 and S&P/TSX Composite Index, and maintain a 34th weekly lead over our 8 year average APAR for the PTP.

In spite of our reluctance to trade under current circumstances, we sold two positions last week on our volatility-based sell-signals and added two more. But we’re still almost 60% in cash. That’s lower than we’d like to be, but remember that September is the worst month of the year to be invested in stocks.

PTA Perspective… Are You Ready for a Cold Winter?

We occasionally like to discuss how you can play the commodities markets using ETFs, especially those with some leverage attached. It’s risky, but the rewards can often justify that additional risk. This time we’re going to walk you through a natural gas trade… one that has significant support from seasonality research as well. The colder it gets this winter, the more this trade may warm your wallet.