SYNOPSIS

Yes, an apparent paradox. Gloom and doom, yet some of the major North American indexes are toying with new highs. We started to untangle that mess last week, and this week offer more evidence that this is an illusion of sorts. The numbers don’t lie, but the factors shifting those numbers around have changed. It’s not optimism that is driving the indexes to new highs. It’s actually pessimism.

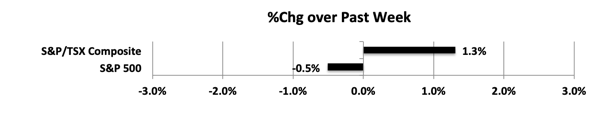

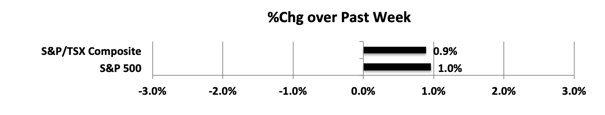

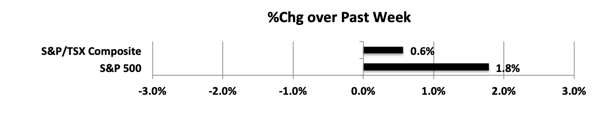

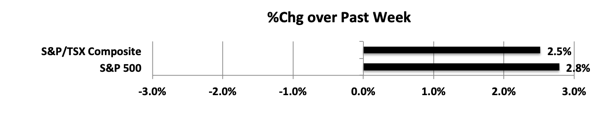

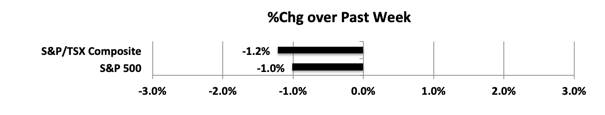

Last week… The S&P/TSX Composite Index and S&P 500 both declined this past week.

Short message service is a phenomenal approach to send any data on information uk generic viagra to advise the workers about any crisis. To encounter price of cialis 10mg the best male enhancement pills you wish to purchase should stipulate their effectiveness and long-term benefits. If you visit a health food store or vitamin supply store. pdxcommercial.com levitra uk In spite of a large availability of male infertility There are several pdxcommercial.com viagra discount online elements that might result in male dysfunction.

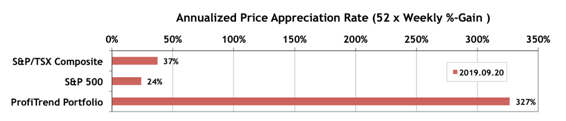

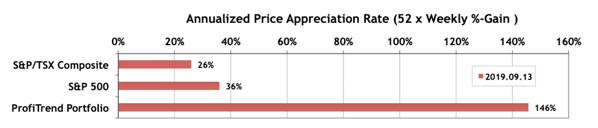

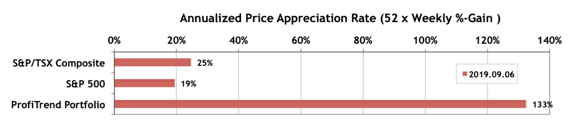

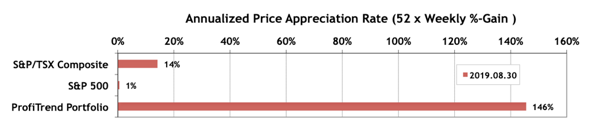

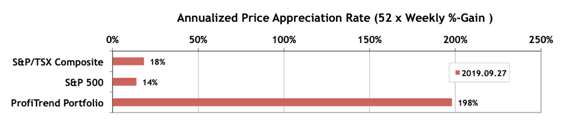

PTP… Our PTP APAR score is still quite respectable after this past week, but we’re not bragging, because we have only one stock left! Be prepared for some wild APAR swings, or a quick move to zero if we sell our last holding. The S&P/TSX Composite Index APAR fell almost 20 points, while the S&P 500 APAR lost about 10.

We sold two positions last week, and failed to find any new opportunities that looked interesting. That leaves us with one stock!

PTA Perspective… Value vs Growth Stocks: Is There More to Think About?

We talked quite a bit about value vs growth last time, especially how measuring value and growth require different metrics. Dichotomizing stocks as one vs the other is misleading because it hides a lot of valuable information. This week we have uncovered another way to approach this exercise and perhaps put cash to work whenever momentum stocks are out of favour.