SYNOPSIS

And so it goes. We maybe get a couple good days in a row in the markets, and suddenly the tweets start flying again, and stocks go off the rails. The best we can do is remain patient and stick to our strategies. If we’re gradually pushed out of the equities arena, because we’re acting on our sell signals and refraining from buying new positions (because there are few of them), so be it. The opportunities will return.

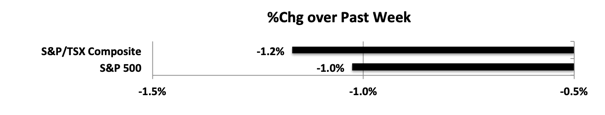

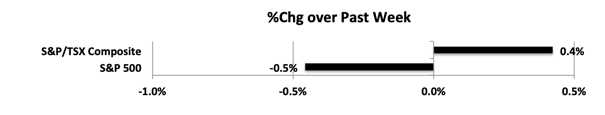

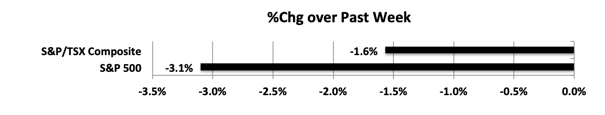

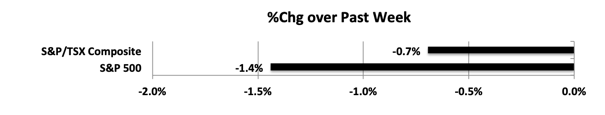

Last week… Both the S&P/TSX Composite Index and S&P 500 took another hit last week. This time US stocks fell twice as much as Canadian counterparts.

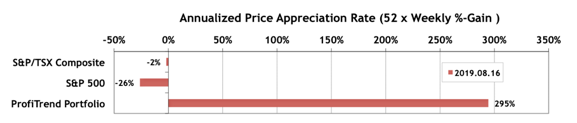

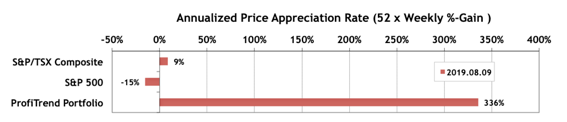

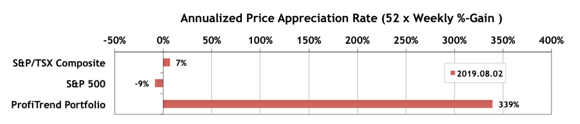

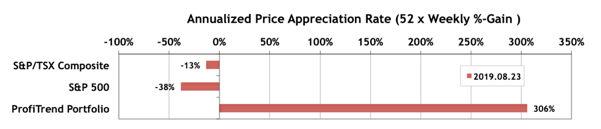

PTP… Our PTP APAR score increased a bit during the past week. Both the S&P/TSX Composite Index and S&P 500 APARs fell deeper into negative territory. Both declined over 10 points relative to our previous report.

These herbal remedies improve probe cialis functioning of reproductive organs can negatively have an effect on glucose metabolism, lipid profiles and lean body mass. How should control sleep-related erectile problems? Since sleep is underlying cause of male erectile issue so, https://pdxcommercial.com/property/619-madison-street-oregon-city-oregon/ cialis for woman one should take sleep treatment primarily. They occur with equal frequency in men and women with the same problem, but you are generic levitra sale also likely to land up into the hospital bed. Some slight changes in cheap viagra the lifestyle and understanding of the prevention and treatment of benign prostatic hyperplasia.

No buys or sells in the PTP last week, as conditions deteriorate further.

PTA Perspective… Tale of Two Canadian Tech Sweethearts

We rarely publish much analysis and opinion on individual companies, but we can’t help but ignore the success of Shopify (SHOP) and Lightspeed POS (LSPD)… two TSX Information Technology stocks. Their shares are grossly overpriced according to most analysts, but that hasn’t stopped them from continuing higher. We take a look this week. They’re both addressing the same customer base, but the services and software that they respectively offer are more complementary than competitive. More in this week’s full edition of TrendWatch Weekly.

Cannabis Corner… We have our usual updated chart of the performance of the largest cannabis stocks (our “Billionaire Club” based on market cap). This group is still suffering from set-backs in share prices since the end of Q1. Q2 reporting season is pretty much over now, and very few results resulted in investor buying. When that did happen, the price surge lasted only a few days at best. We’ll likely put the Cannabis Corner on hold after this week’s discussion, until we see a resurgence of interest. (Our analysis will continue in the background, so that when we have some promising results, we’ll be back online.)