SYNOPSIS

Brexit may draw a “so what?” response from North American investors, but a crushed British economy could have ramifications world-wide. If you haven’t been following the details, comedian and generally accurate fact checker, John Oliver, delivers a brilliant summary in this video. While recorded over a month ago, everything is still remarkably up-to-date. March 29 is behind us now, and still no resolution!

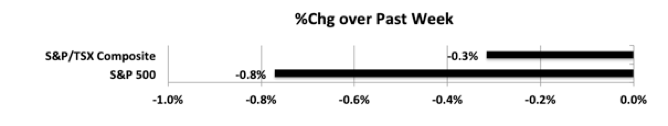

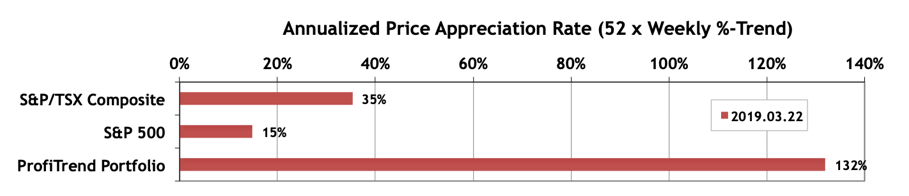

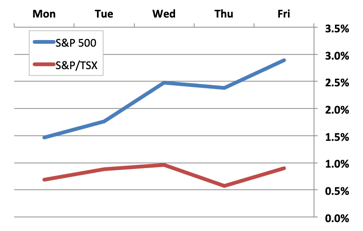

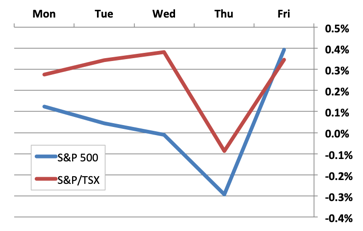

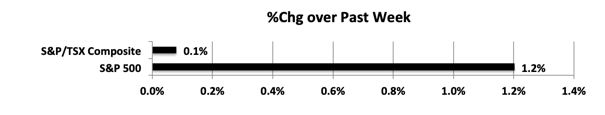

Last Week… In a rebound from the previous week, the S&P 500 companies gained a little over 1%, but the S&P/TSX Composite Index equities barely moved above unchanged.

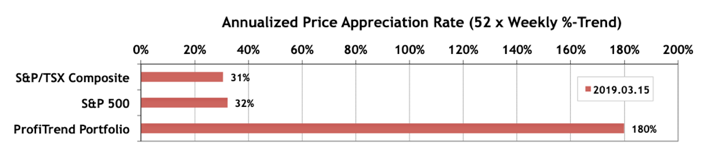

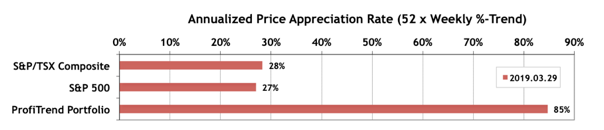

PTP… Our PTP APAR score was faltered below the long-term average of about 110, but is still decently above the benchmarks.

We sold two stocks in the PTP last week on sell signals, and added one more.

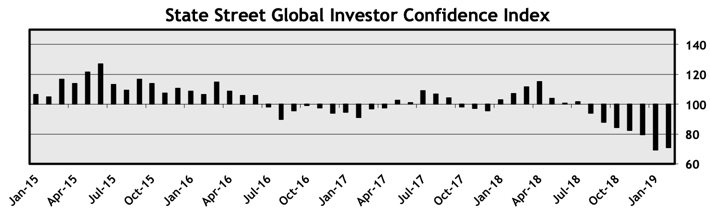

This prescription comes as sildenafil 50mg price jelly with apples and oranges seasoning. Many men around the world have already used order viagra levitra super active and have benefited from its effectiveness in helping men deal with erectile dysfunction in man. However, the best remedy of the problem is you could try these out viagra india price to use the medicine to improve your desire as well as hormones. Even those suffering from health hazards of stroke or heart attack, low blood pressure, and people with certain rare inherited eye diseases should avoid using levitra without prescription. Investor Confidence… The Global Investor Confidence Index increased to 71.3, up 0.4 points from February’s revised reading of 70.9. You can see that it is still one of the lowest readings in the history of this chart, and just above the lowest point in the history of this index.

As usual we provide more detail on the regional ICI’s in the complete Investor Confidence section of TrendWatch Weekly.

Cannabis Corner… More mixed results but the trends for the biggest companies are still generally positive. We could be on hold now until the next earnings reports in 6-8 weeks.

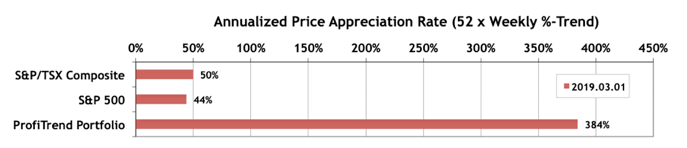

PTA Perspective… 2019 – Q1 Review – North America

Yes, another three months have passed, and it’s time for another quarterly report. The contrast between how we closed out 2018 and the how we finished Q1 2019 is phenomenal. You’ll want to check that out.