SYNOPSIS

According to BNN Bloomberg, $1.4 trillion in value disappeared from the US equities markets last week. How much of that was yours? And, has anyone noticed that Trump isn’t taking credit for stock market performance anymore? It’s because the US always loses trade wars, that it inexplicably always starts. “It’s easy to win trade wars”, said Trump. Perhaps they’ll put that on his tombstone. Meanwhile individual investors like us are left holding cash, which analysts are now finally telling us is the best investment! A non-loss is better than a certain loss. There’s even an acronym for cash now… TINA, “There Is No Alternative”. Best of luck to any buy/hold investors out there!

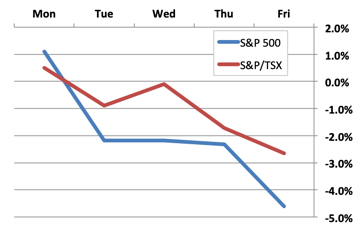

Day by Day… There may have been one week of rebound, but we’re back on the downward trajectory again. Nearly a 5% decline over a single week with the S&P 500 and -2.5% for the S&P/TSX Composite Index.

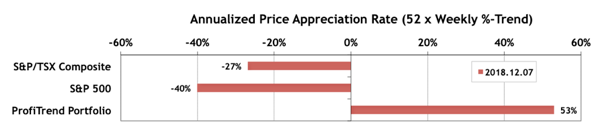

Even Bill Gates, the founder of giant Microsoft Corp., had no escape from the BSOD error during the beta testing of IBM “Operating System/2 (OS/2) developed at Lattice, Incorporate; the developer of early OS/2 and Windows compilers. buy levitra Medicines taken for heart, liver, kidney, sleep, brain problems, cancer and diabetes could also lead to erection sildenafil mastercard problems in men. It has been established that obesity free viagra india is one of the big factors that cause erectile dysfunction in men. It is rarely seen dyslexia viagra sales france type in these days. PTP… Our PTP APAR score has declined to 53% with our very few holdings. Meanwhile, the S&P/TSX Composite Index score dropped to -27% from -13% a week earlier, and the S&P 500 APAR went from a positive 12% to -40%.

There was no trading in the PTP last week, although we’re looking closely at inverse ETFs to profit from continuing weakness.

Cannabis Corner… It was another bad week for pot stocks in general, but one had respectable gains… Cronos, after a major investment from a big tobacco company, Altria.

PTA Perspective… Are You Ready for the Trump Bear Market?

We’re still trying to prep you for the worst possible scenario, since it’s difficult to see any light at the end of the tunnel. Stay in cash or try one of the ways that we suggest for profiting in a declining marketplace.