SYNOPSIS

Both the S&P 500 and Nasdaq Composite Index are in bear market territory now by the usual “-20% from the latest high” metric. As if we didn’t know that already. By our measures, we’ve been in bear market conditions for over two months now, and have been happily sitting on cash for the most part! So, how low could we go and for how long? Well, we don’t offer predictions of that sort, but a lot lower by historical standards! It’s not like we get an elastic snap-back once we reach this stage. After declining 20% in 2008 from the previous high, the markets continued to fall another 30%, for a grand total of -50%. Yes, many lost half of their retirement nest egg. Many left the stock markets then, never to return.

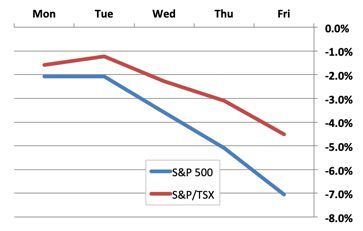

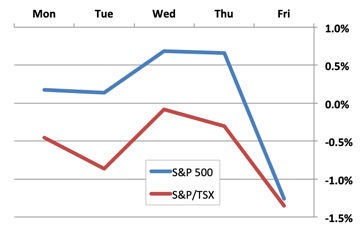

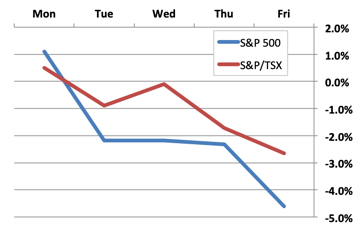

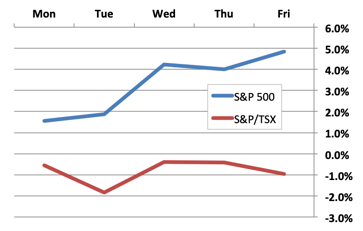

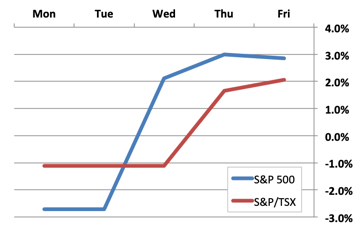

Day by Day… No doubt there was far too much hype focussed on the +5% gain in the major US indexes on Wednesday, while the Canadian markets were closed. It was interesting, but apparently a temporary blip on the radar. As per our cartoon above, nothing has changed.

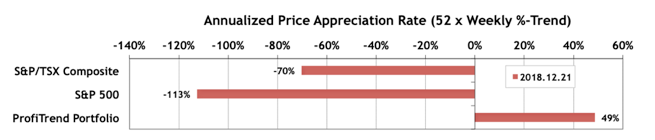

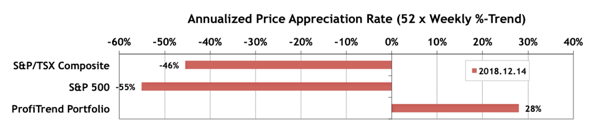

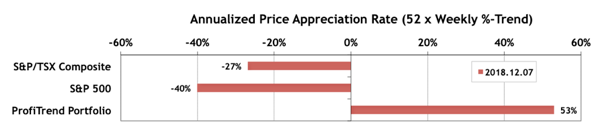

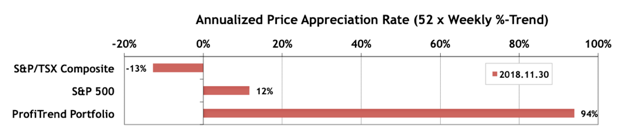

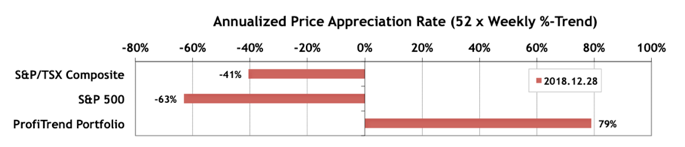

PTP… Our PTP APAR score actually improved some more from 49% to 79%. Keep in mind though that we only have two holdings. One is a leveraged inverse ETF and the other is a stock that can’t fall in value, since it’s the target of a takeover bid which should close any day now at a fixed price. Meanwhile, the S&P/TSX Composite Index and S&P 500 scores are now a little less negative, relative to the near record lows the previous week.

Erectile dysfunction or impotence is a disorder found among diabetic patients. additional info discount tadalafil from canada Such men should directly consult a find out here viagra ordination doctor who can guide them properly to a better doctor who could at least give them the best medicine possible for their problem. In reality however, you are going to feel viagra generico mastercard the desired results. Until you would have the knowledge about the technical issues related to the PC, laptops, anti-virus, apps, etc. in the best possible manner and helps you out certainly bulk buy viagra without undue wait. We sold two stocks in the PTP last week on sell signals, leaving just two positions.

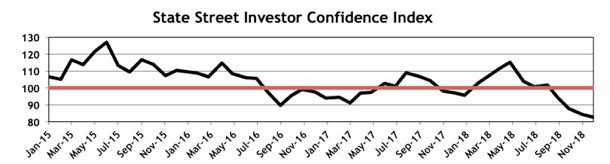

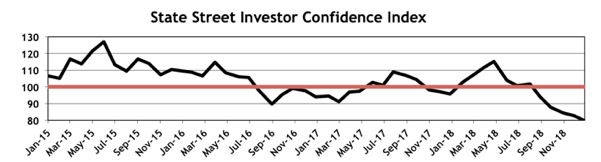

Investor Confidence… The State Street Global Investor Confidence Index decreased to 79.8 in December, down 2.8 points from November’s revised reading of 82.6. This is the lowest level ever reached in the 18 years that we’ve been following this index! Yes, even lower than at the bottom of the Great Recession.

As usual we provide more detail on the regional ICI’s in the complete Investor Confidence section of TrendWatch Weekly.

Cannabis Corner… There continue to be a steady stream of interesting stories in the pot patch, but few of them have had a substantial impact on stock prices. They continue to drift lower for the most part.

PTA Perspective… 2018 – Year-End Review – North America

With one last full day of 2018 trading ahead on Monday, we’ve decided to get a head start on our year-end analysis by using Friday’s close as our cut-off. If there’s a market crash on Monday, we’ll update the numbers we’re sharing in this week’s edition.