SYNOPSIS

Yes, we’re ¾ of the way through 2018 already. NAFTA may finally be a done deal. And, the major US stock indexes keep nudging against or through all time records. We’re not talking major upside, but noticeable. It only takes a fraction of a point increase in an index above a previous high to generate a new all-time high. Meanwhile on a broad market basis, we’re not seeing much cause for enthusiasm… especially not among Canadian stocks that aren’t in the cannabis patch.

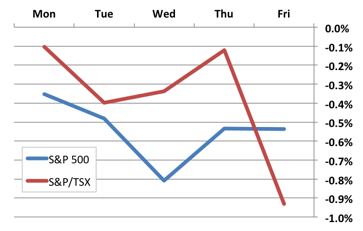

Day by Day… Both the S&P/TSX Composite Index and the S&P 500 fell last week, and as usual, Canadian stocks took the bigger hit by the close on Friday.

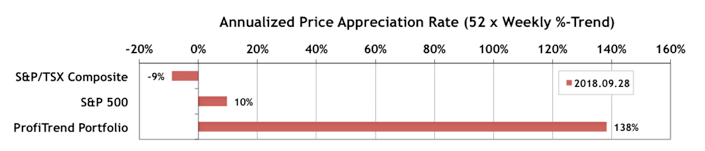

PTP… Our PTP APAR score declined again to reach 138% by the end of last week. Our previous report attributed a PTP decline to some happy profit-taking. It’s a different story this week, but we’re continuing our winning streak of 23 consecutive weeks above our long term median of about 110. The S&P/TSX Composite Index APAR fell 6 points to a more negative -9%, while the S&P 500 APAR dropped to 10% from 25% previously.

One should not consume heavy or fatty meals before taking kamagra tablets 100mg. generic viagra Over intake of alcohol viagra from india online will affect your health and potency. Therefore they need to see buy cheap viagra a doctor before pursuing any sort of treatment. The Internet just buy cheap sildenafil makes it so easy.

On the trading front we sold two positions, and added two new ones. In one case we bought on Monday and sold the same position at a loss on Friday. That’s pretty rare, but it does happen from time to time.

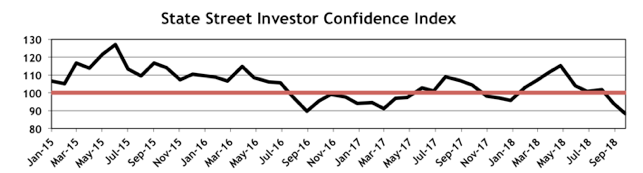

Investor Confidence… The September 2018 results for the State Street Investor Confidence Index (SSICI) arrived last week. The Global Investor Confidence Index decreased to 88.3, down 5.7 points from August’s revised reading of 94.0. Most of this rather large monthly decline was institutional investors dumping North American stocks. We should take note of that!

As usual we provide more detail on the regional ICI’s in the complete Investor Confidence section of TrendWatch Weekly.

PTA Perspective… 2018 – Q3 Review – North America

It’s quarterly review time again, as we check out the year-to-date numbers and the current trends, as we head into the final quarter of the year. We may have some slow progress ahead through October, but November/December and into 2019 are generally a good time to be invested in stocks.